Paytm is one of the most popular digital wallets in India, offering a range of services such as UPI payments, bill payments, recharges, online shopping, and more. However, Paytm is not the only option for users who want to enjoy the convenience and security of a digital wallet. Moreover, with Paytm shutting down its Payments Bank on March 15, it will become a hassle for customers who use Paytm’s bank to transfer money to the Paytm wallet. If you have to leave out the convenience of seamless transactions between the Paytm wallet and Paytm Payments Bank, then there are other options you should consider, which may also not be as seamless but have better offers and discounts. This article will explore the top 5 alternatives to the Paytm wallet in 2024 based on their features, benefits, and popularity.

What is a Digital Wallet?

A digital wallet is a mobile application that enables you to keep your funds, carry out transactions, and monitor payment records all on your phone or tablet. You can store all of your financial information in a digital wallet, and some of these apps can even store your identification cards and driver’s licenses. In January 2023, digital payment transactions in India amounted to a staggering Rs 12.98 lakh crore.

In other words, Wallets are services that are made by and linked to financial services, such as Paytm, to store and keep money, similar to what a person would do with a physical wallet. You can link your bank accounts to these digital wallets, which can then be used to make online and offline payments at merchants. Moreover, wallets can also prevent your bank statements from becoming crowded with petty transactions.

Coming to the alternatives of Paytm Wallet, these include:

Amazon Pay

Amazon Pay is Amazon’s own digital wallet that is integrated with its e-commerce platform. This service by Amazon lets users make payments for online orders, utilities, recharges, and more using their Amazon account balance or linked cards. The service also offers exclusive deals, cashback, and discounts for Amazon customers. Amazon Pay is a convenient option for users who shop frequently on Amazon and want to enjoy the benefits of its loyalty program’s benefits.

Read More:

Top 5 Alternatives of Paytm Fastag

Top 5 Alternatives of Paytm Payments Bank for your Digital Banks needs

Top 5 Digital Banks Offering Better Interest Rates Than Paytm Payments Bank

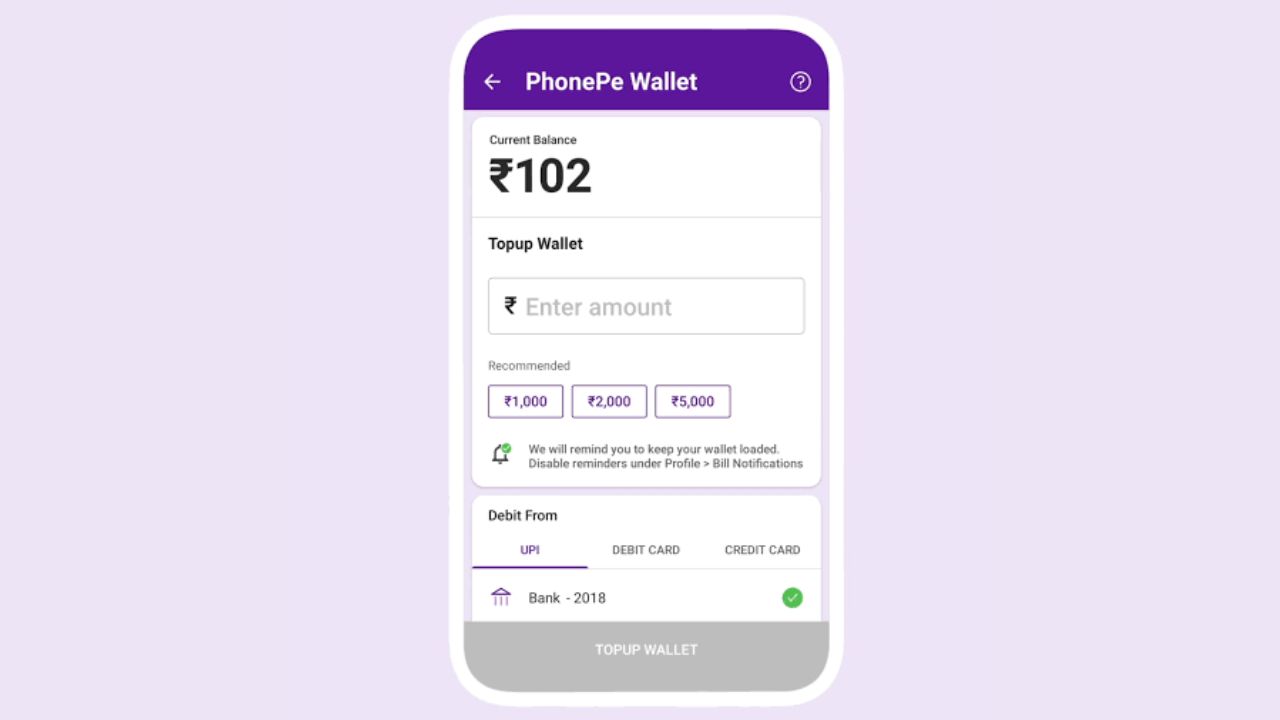

PhonePe

PhonePe is currently the market leader among the UPI apps in India, with a 46 percent share as of December 2023. It is a versatile and secure App that offers UPI payments, wallet payments, and bill payments across various providers. PhonePe also allows users to invest directly in stocks, mutual funds, and digital gold within the app. PhonePe also offers a wallet feature similar to that of Paytm, which users can use to make payments.

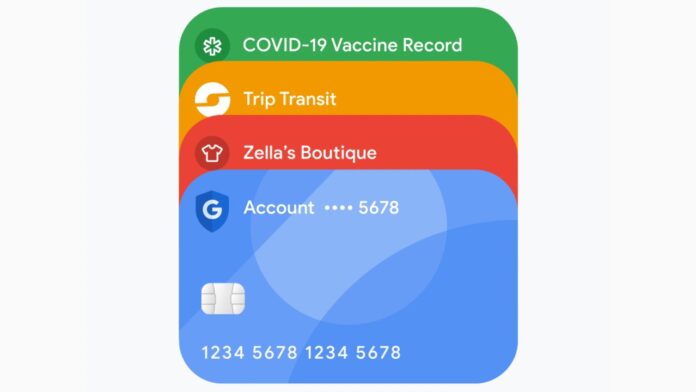

Google Pay

Thanks to its UPI Lite functionality, Google Pay is again one of the best alternatives to the Paytm wallet. While you may not be able to store as much amount as other wallets as UPI Lite restricts you with a limit of Rs 2,000, it’s still a convenient option to pay at outlets as UPI Lite transactions don’t require a PIN.

UPI constitutes a majority portion of the online transactions in India, and UPI Lite is offered as an on-device wallet with no charges for money transfers and account closing. Further, you can make payments of up to Rs 500 without using a UPI PIN on the Google Pay app.

Read More: Top 5 Digital Banks Offering Better Interest Rates Than Paytm Payments Bank

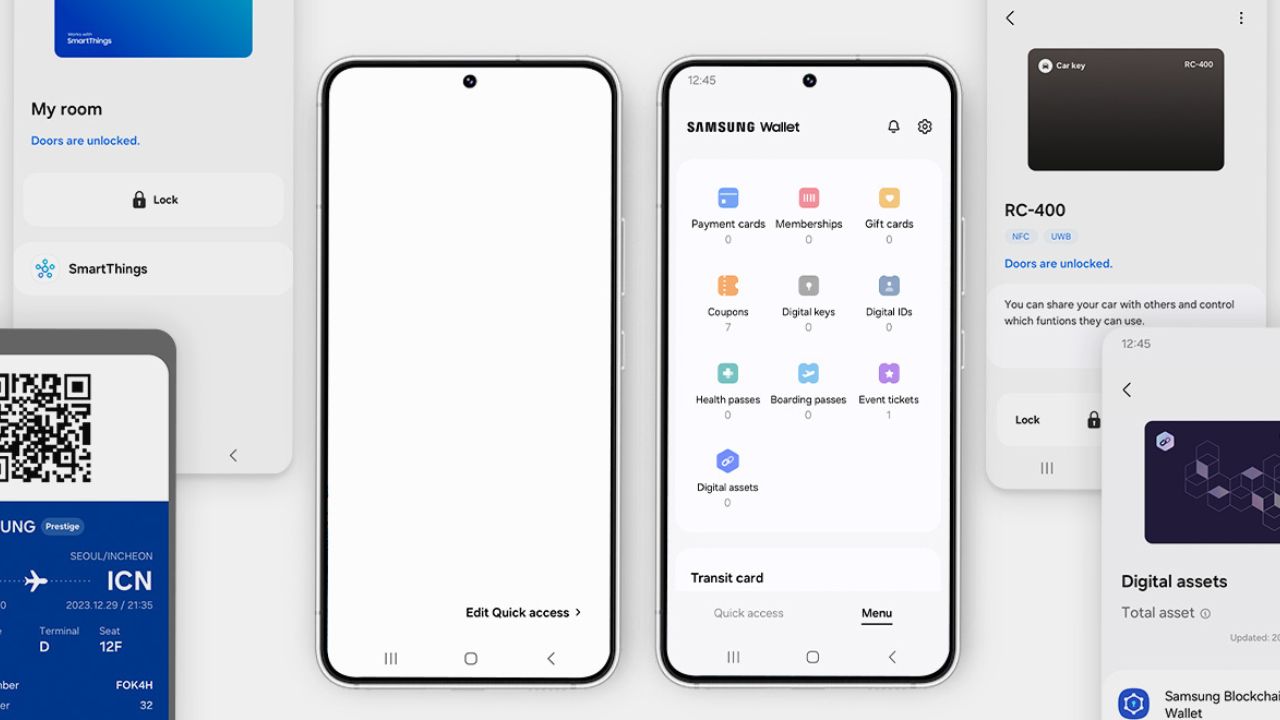

Samsung Wallet (Exclusive To Samsung Users)

If you are a Samsung smartphone user, you get access to Samsung wallet. It is your one-stop app for essentials — keys, credit cards and boarding passes. All in one spot, all accessible with one swipe. While it may not allow you to store money, it does allow you to store all types of debit and credit cards, link your UPI and also link your DigiLocker account from where you can access your personal IDs such as Adhaar card, driver’s license and more. It also offers Tap-to-Pay functionality for credit and debit cards. This is a perfect alternative to Paytm wallet, except for the money storage functionality.

Samsung Wallet has 3 ways to use it. Swipe the screen up or tap the icon to open the app. You can also easily open the Samsung Wallet by double-tapping the side key. It also supports Samsung Pass, which can save all your passwords. Simply verify yourself with your biometric data, and you’re logged in to your apps and services.

JioMoney

JioMoney is a digital wallet that lets you use your smartphone to make smart, simple and secure digital payments on the go. You can shop, pay, send money and more with JioMoney in MyJio and other apps and platforms. JioMoney also offers cashback, coupons, and vouchers for various online and offline stores.

Bonus: Bank-specific Wallets

While the above-mentioned wallets are general ones that support all banks, some wallets are offered by the banks themselves. If you are more comfortable using wallets offered by your specific bank, these include:

HDFC PayZapp

HDFC Bank’s PayZapp is an online payment app that doubles as a digital wallet and a virtual card. You can use PayZapp to pay for online and offline services like paying bills, sending money, shopping online, etc., without using your bank account or cards. Both, HDFC Bank and non-HDFC Bank customers can access the PayZapp app. The PayZapp transaction limits are Rs 10,000 per month for non-KYC Accounts and Rs 2,00,00 monthly for KYC-compliant customers.

Pockets by ICICI

It’s a VISA-powered e-wallet by ICICI Bank that customers of any bank can use to recharge their mobile, send money, shop anywhere, pay bills and much more. Pockets wallet also comes with a physical shopping card, which can be used to shop on any website or retail store. With Pockets bank e-wallet, you can transfer money to bank accounts and mobile numbers. It also offers unique deals from various brands as a part of its promotional program.

Airtel Money Wallet

The Airtel Payments Bank is one of India’s first digital banks approved by RBI. It also offers a Wallet service, which is one of the perfect alternatives to Paytm wallet as it essentially offers the same service. Airtel Money, Airtel’s digital wallet – allows customers to recharge, pay bills, shop online and do much more.

Minimum KYC wallets can be opened with details such as customer name, date of birth, pin code, mobile number and any type of POI. With this wallet, customers can easily engage in credit/debit transactions. It comes with a limit of Rs 9,000 and is quite handy for fast-track payments such as recharges, utility bills and more. It is accessible to non-Airtel network users as well.