The Paytm Payments Bank has been ordered by the Reserve Bank of India (RBI) to suspend its banking services operations post-February 29, 2024, due to alleged repeated non-compliance with the Know Your Custome (KYC) regulations that the central bank has laid down.

RBI is contemplating revoking Paytm Payments Bank’s license due to its ongoing crisis, as per media reports. The intention at present is to cancel the license of Paytm Bank after the March 15 deadline for closing the business and settling transactions elapses. This development underscores the escalating challenges confronting Paytm’s payment bank, which is grappling with an existential crisis.

One key benefit of Paytm Bank was the zero balance account. However, given its future uncertainty, many Paytm customers may be considering other digital banking options. To help with your decision-making process, we’ve compiled a list of the top five alternatives to Paytm Payments Bank that you may want to consider.

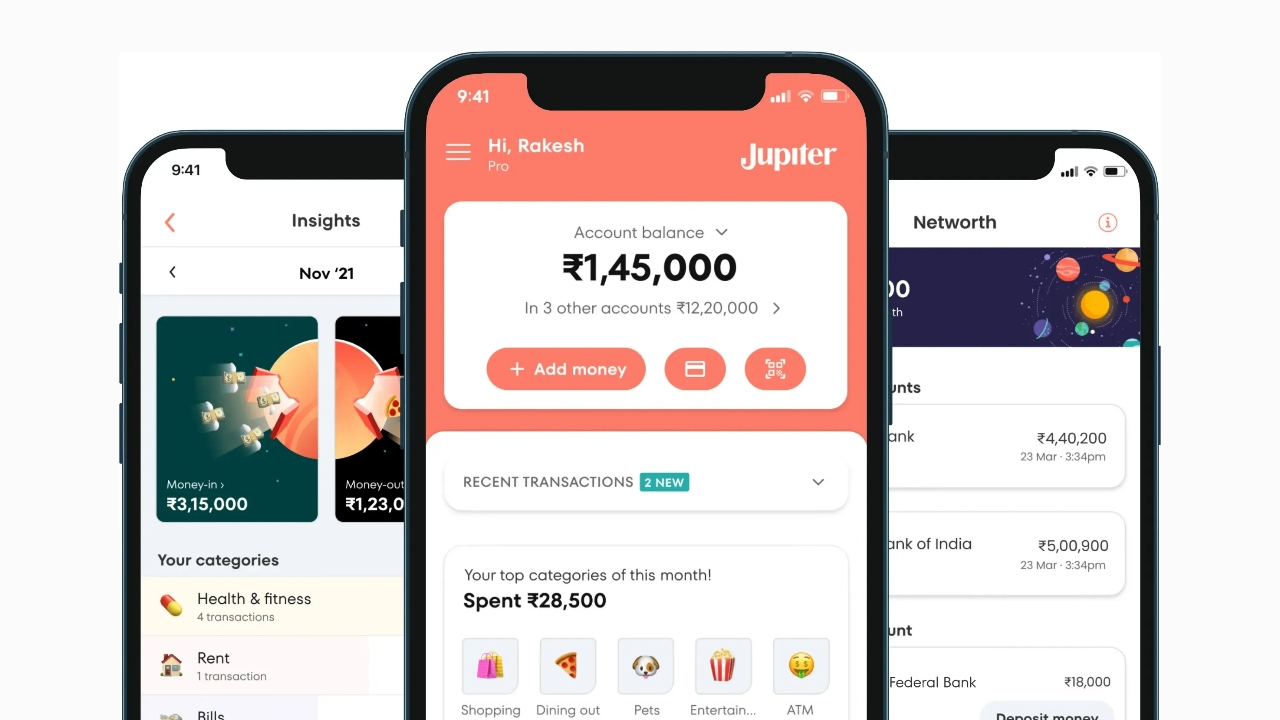

Jupiter

Jupiter is a digital banking platform that offers a zero-balance savings account opened in partnership with the Federal Bank. It is marketed as an all-in-one App for banking needs where most of the operations can be done through the app. Jupiter provides round-the-clock customer support and lets customers complete the KYC process digitally via a video call.

Other features of the app include the ability to scan any QR, pay with a credit card, up to 5% assured cashback on Jupiter UPI spends, and flat 1% cashback on non-UPI credit card spends. You can track your UPI and credit spends with Insights and also get a lifetime free EDGE CSB Bank RuPay Credit Card exclusively on Jupiter if you are eligible. The bank also gives you a VISA debit card for use without charging any extra cost.

As for the rewards system, which is a major advantage over Paytm Payments Bank, you can earn instant rewards in the form of Jewels on your spending and redeem jewels for cash or gold. The banking and payment partners for the bank include Axis Bank, NPCI, RuPay, VISA and more. The app also allows you to invest in gold, mutual funds, and fixed deposits with up to 7.5% interest rate.

The bank provides you with an interest rate of 3.05% on your balance of less than Rs 5,00,000 every quarter—the interest rate increases as the balance in your account increases.

Airtel Payments Bank

In a dynamic digital banking landscape, Airtel Payments Bank emerges as a frontrunner, offering a myriad of features tailored to modern banking needs. Established on April 11, 2016, Airtel Payments Bank was the first recipient of the Payments Bank license from the Reserve Bank of India under Section 22 (1) of the Banking Regulation Act, 1949.

Airtel Payments Bank distinguishes itself through a comprehensive suite of services to enhance user convenience and security. Its notable offerings include seamless bill payments, savings accounts, instant money transfers, and a suite of financial products catering to diverse consumer needs.

Furthermore, Airtel Payments Bank introduces a security feature known as Airtel Safe Pay, providing an additional layer of protection for online transactions. With Airtel Safe Pay, users can authorize transactions securely, ensuring that no funds leave their bank account without explicit approval.

Airtel Bank allows users to open a bank account using Video KYC. You’ll need an Aadhaar card and an active mobile number to get started. The bank also offers a digital wallet feature that enables you to manage your finances, recharge your mobile, pay bills, make purchases at physical stores, send money to friends, and make payments on various online platforms such as MakeMyTrip, BookMyShow, Myntra, and many more.

With Airtel Payments Bank, you can open a zero-balance savings account without maintaining any minimum balance limits. You can enjoy all the UPI features and earn up to 7% interest on your savings, which will be credited to your account monthly. The interest rate for balances up to Rs. 1 lakh is 2%.

Airtel further offers a 12-month subscription to its Rewards123 program where there’s 1% cashback on loading Rs.1000 via any payment mode excluding Credit Cards (Maximum Rs.10/month) – 2% cashback on minimum Rs.1000 of online purchases with your debit/prepaid card or via your Rewards123 Savings Bank Account/Wallet at any of the listed online partners (Max. Rs.40/month) – Flat Rs.30 Cashback on minimum Rs.225 Mobility Prepaid, Postpaid, Broadband/Landline, DTH bill payment/recharge.

Read More: Paytm Reassures Users: FAQs Address Concerns Amid Regulatory Turmoil

Kotak811

Kotak 811 Zero Balance Savings Account is distinct from the regular Kotak bank account and can be opened entirely online. It provides 4% interest p.a. on savings account balance above Rs 50 lakhs and 3.50% interest p.a. on savings account balance up to Rs 50 lakhs. However, there are no reward schemes available with this bank account.

Kotak 811 account holders can transfer funds for free online using NEFT, IMPS, or RTGS. They can also easily shop online using either their Virtual Debit Card (VDC) or their physical debit card. However, please note that the physical debit card has an annual fee of Rs 299. It’s worth noting that the bank is RBI-approved and offers an FD facility with an interest rate of up to 7%.

Jio Payments Bank

Like Airtel, Jio also has a digital payments bank running called Jio Payments Bank. However, it’s a little different from Airtel because it has partnered with a bank to run its services, whereas Airtel’s Payments bank is self managed digital bank.

Reliance Industries Limited was granted an in-principle approval by the Reserve Bank of India to establish a new Payments Bank under the Banking Regulation Act, 1949. It then partnered with the State Bank of India to support this initiative of building Payments Bank capabilities and accordingly, Jio Payments Bank Limited, was incorporated in November 2016.

It provides a 3.5% interest per annum on your savings account balance which is payable quarterly. You can open a Jio Payments Bank account even without a Jio number. It’s KYC process is also completely digital meaning you can complete it via a video call. However, do note that Jio doesn’t provide you with a debit card or any kind of rewards.

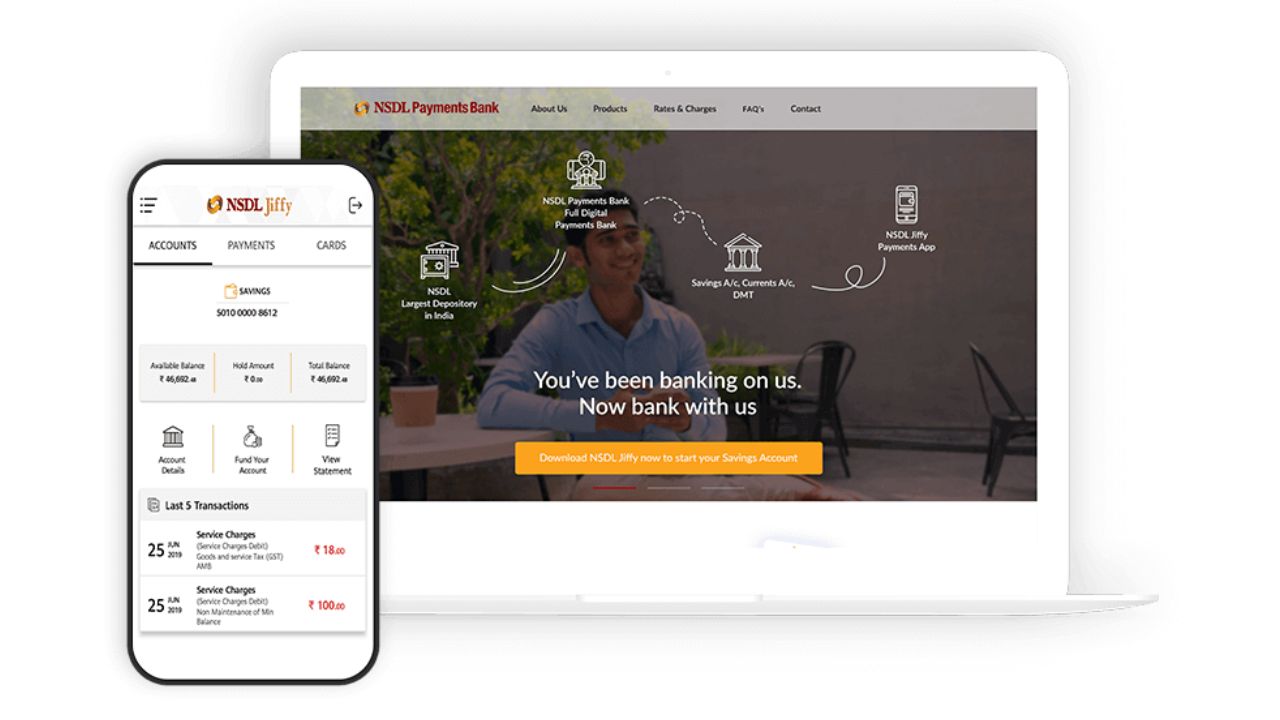

NSDL Jiffy

NSDL Payments Bank was launched in October 2018 with the aim of providing simplified banking services to every Indian. NSDL Jiffy is the platform that takes care of banking services. The bank has obtained a license from the Reserve Bank of India to carry out payments bank business under Section 22 of the Banking Regulation Act, 1949.

In addition, there’s a per annum interest of 2.5% on balance up to Rs 1 lakh and 5% on balance above Rs 1 lakhs. In addition, NSDL will also issue you a virtual debit card for free while the physical debit card will have a fee of Rs 300 plus GST on an annual basis. While Intra bank and NEFT transactions can be made without any fees, there’s a minimum fee of Rs 2.5 on transactions up to Rs 10,000 and Rs 25 fee on transactions amounting from Rs 2,00,001 to Rs 5,00,000. NSDL Jiffy assures paperless and queue free process, right from account opening to fund transfer, bill payments and investments.

These were our top 5 alternatives for Paytm Payments Bank on the basis of interest rates and the fact that they are RBI approved so you don’t have to worry whether these banks are recognised by the central bank or not. There are other options also available in the digital banking space, such as Fi Money, IndusInd zero balance savings account, and more, if you want to check those out too.