A PAN card or Permanent account number card is one of the most useful documents an Indian adult needs. Since its inception in 1972, it is used for a whole host of financial reasons and can also double up as an identity card sometimes. Other countries have their version of PAN cards. Such as TIN ( Tax Identifier Number) in USA and UTR (Unique Taxpayer Reference) in UK. All these protocols work in a similar fashion.

Here are some general points related to PAN cards which will quell all your doubts:

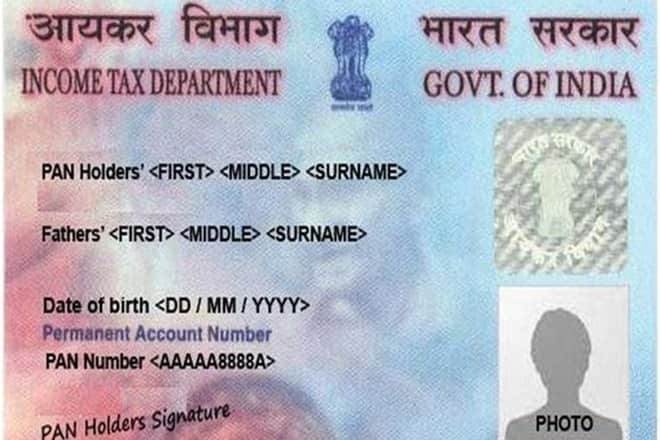

What is a PAN Card?

A PAN card is a 10 digit Alphanumeric identifier.issued in the form of a card. The card is issued by the Income Tax department and is used for various reasons. Some major ones include banking and filing taxes.

How to register for a PAN card?

You can get a PAN card by following these easy steps:

Step 1: Open the NSDL site https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html to apply for a new PAN.

Step 2: Select application type

Step 3: Select Category

Step 4: Fill in all the details

Step 5: Click on Continue with PAN Application

Step 6: You will be re-directed to a page which will ask for an e-KYC

Step 7: Fill the form, and click on the proceed button

Step 8: You will get to see your form once again, in case you want to make any changes.

Step 9: Proceed to the payment portal and fill in the fees.

Step 10: Once you have done the payment, you will get an acknowledgement slip.

Step 11: Print the slip, attach two recent photographs, enclose the fees’ demand draft and send it via post to the NSDL

How to check your PAN card details online

You can check your PAN card details online via the NSDL website. Click on “Verify PAN” and enter the details. You will then receive all the necessary details such as your PAN number and more.

How long does it take to issue a PAN card?

You should receive your PAN card within 2 days. However, the Government of India has informed that there could be a delay due to the Coronavirus Pandemic. You can, however, get your E-PAN meanwhile, but your physical card will take some time.

How to link PAN to Aadhar

The supreme court had announced that PAN cards can be linked to Aadhar. This can help you to organize all your important files with one identity.

For connecting your PAN to your Aadhar, visit the income tax site and log in.

In your account settings, you can find an option to enable link with Aadhar. Upon selecting that, a form will be displayed. After filling the form, your PAN will automatically get connected to your Aadhar card.

How to change details in PAN

You can easily update your details from this site.

Step 1: Under the services menu, click on PAN

Step 2: Click ‘Apply’ under ‘Change/Correction’

Step 3: From the ‘Application Type’ dropdown menu, select ‘Changes or Correction in existing PAN data/Reprint of PAN Card

Step 4: Select the category from the drop-down menu

Step 5: Enter all your details

Step 6: You will then have to fill a form containing the details to be changes

Step 7: Upload all necessary documents

Step 8: After this, you will again receive an acknowledgement letter which you have to mail to the NSDL, similar to the first point

What is the cost for a PAN card?

The cost of issuing a PAN card is Rs 93. However, it is Rs 864 for NRIs. Changing any details in PAN cards are free of charge, and you don’t have to pay any money then.

What is PAN Card used for?

Tax Filing

A PAN card is required for tax filing and IT returns. This is the primary reason for the PAN card.

Proof of Identity

Pan card is accepted as valid ID proof in many areas. PAN Card, along with Aadhar is accepted in financial institutions and other organizations

Opening a bank account

All public and private banks have made it mandatory for an individual or a company to require a pan card while opening a bank account.

Only people under the PM’s Jan Dhan Yojna, a person can open a zero balance account without a PAN card.

Foreign Travel

Cash payment related to foreign travel which exceeds Rs 50,000 requires a PAN card. This is inclusive of forex purchase

Is PAN Card necessary for a job?

Yes. A PAN Card is required if you are earning. This is because job holders are required to pay taxes. Though the taxes may get deducted before you receive your salary, you will need a PAN card to register your filings.

Can a person with no income apply?

A person without any income can also apply for a PAN card. Students may require PAN cards for opening bank accounts. Also retired people who are not earning need to file taxes. Due to this, no income is necessary to register for a PAN card.

What are the alternative documents?

Though it is highly advisable to have a PAN card, sometimes a situation might arise where you don’t have access to one. There are a few alternatives which can get the job done. However, certain institutions require a PAN card only.

Ever since PAN and Aadhar can be linked, your Aadhar number can be used interchangeably with your PAN. This is useful during income tax filings. The department of income tax will generate your PAN number from your Aadhar itself.

Form 60 is another replacement for an Aadhar card. Form 60 is nothing but a signed declaration stating that you do not have a PAN card and your income is below taxable limits. This can be used everywhere, but your income will be scrutinized. This is useful for students who wish to open a bank account but don’t have a PAN card.

Is PAN Card mandatory for NRIs?

A PAN card is required by an NRI if he/she has a taxable income in India. According to the new laws, NRIs not having a PAN card cannot invest in shares or mutual funds in India.

What documents are required for a PAN card?

The documents required to apply for a PAN card are:

- Any identity proof (Eg. Aadhar Card, Voter ID Card, Driver’s License)

- Proof of address (Eg. Electricity bill, passport, domicile )

- Proof of date of birth (Eg. Birth Certificate, Board exam mark sheet, marriage certificate)

Can you open a bank account without a PAN card?

There are a few ways one can open an account without a PAN card. Form 60 is one such way. Form 60, as mentioned above is a signed declaration stating that you don’t have a Pan card. This is accepted by banks all across India as a valid replacement for PAN.

Another way is via PM’s Jan Dhan Yojna. However, this method is reserved mainly for retired people and others having very small income which can’t be taxed.

Is E-PAN Valid? How to get it?

While applying for a PAN, one can get an E-Pan almost instantly. Just go to the NSDL site and click on ‘Request E-PAN’. You will have to fill a form and immediately a pdf will be received containing your PAN with a digital signature.

E-Pan is valid everywhere. It is nothing but your PAN card in digital format. As such, one can use it interchangeably with their physical PAN card.