Micromax has returned to prominence by investing in Streambox Media, a company launched on February 15, 2024. Streambox Media is introducing India’s first subscription-based smart TV service under the brand Dor. This marks a strategic move for Micromax, leveraging its manufacturing capabilities and brand recognition to re-enter the consumer electronics market.

Leadership and Board Composition

Streambox Media’s board consists of Vikas Jain, Rahul Sharma, Rajesh Agarwal, Sumeet Kumar, and Anuj Gandhi. Except for Anuj Gandhi, all are Micromax directors, indicating a strong connection between the companies. This leadership structure suggests that Streambox Media’s direction and operations will closely align with Micromax’s broader strategy, potentially tapping into the latter’s market experience and resources.

Subscription Model and Pricing

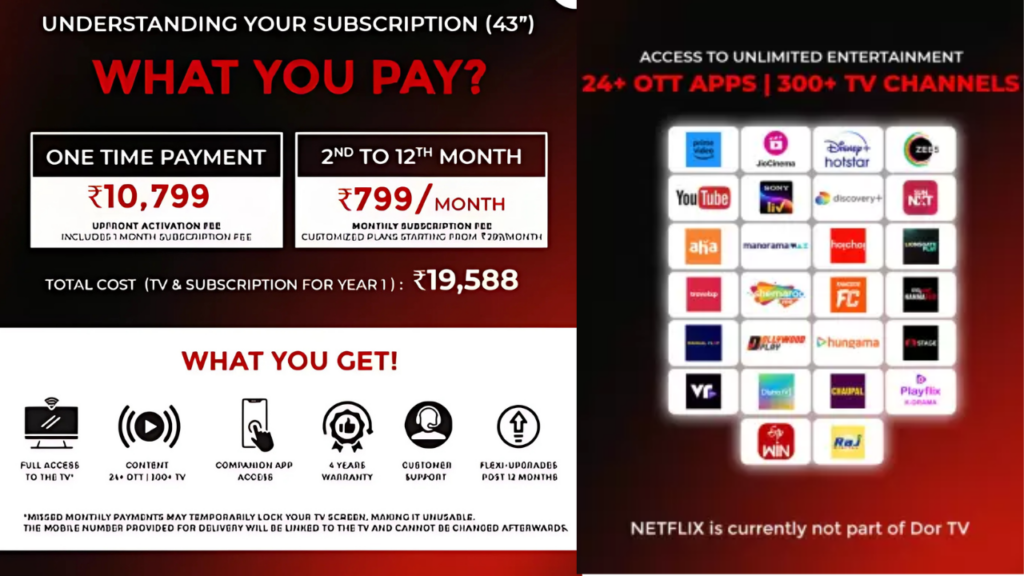

Dor TVs operate on a subscription-based model, a first in India. The initial offering includes a 43-inch 4K Ultra HD model priced at Rs 10,799, which covers the activation fee and the first month’s subscription. After the first month, subscribers pay Rs799 monthly. Larger models, including 55-inch and 65-inch models, will launch in early 2025, priced at Rs 16,999 and Rs24,999, respectively.

This pricing strategy spreads the cost of ownership over time. After 12 months of continuous subscription payments, customers can return the TV for up to Rs 5000 refund. The refund amount for the 55 and 65-inch models has yet to be announced. Failure to pay the subscription fee will lock the TV, and the registered mobile number cannot be changed. This lock-in mechanism could be a deterrent for consumers who might want to change their service preferences later.

Content Offering

Dor provides access to 24 + OTT platforms and over 300+ live TV channels. Major platforms include Prime Video, Disney+ Hotstar, Zee5, Sony Liv, YouTube, Discovery+, Sun Nxt, Aha, Hoichoi, and Lionsgate Play. Netflix is expected to be added soon. This bundled service aims to consolidate multiple subscriptions into one, simplifying the viewing experience for consumers.

The Dor companion App allows content to be accessed on up to five mobile devices per subscription. However, it seems that additional OTT services cannot be added to the plan in the first year, limiting flexibility. The inability to customize the subscription or add new apps might be a drawback for some users in the first year.

Technical Specifications and Manufacturing

The Dor TV offers 4K Ultra HD Resolution with a 60 Hz refresh rate and an IPS panel. It includes two 40W down-firing speakers with Dolby Audio. Connectivity options include 2 USB ports, 3 HDMI ports, Dual-Band WiFi (2.4GHz and 5GHz), Bluetooth, and an Ethernet port. The solar-powered remote control features a 110 mAh rechargeable solar cell, chargeable via indoor or outdoor lighting, and supports USB Type-C charging. The remote’s voice search function adds a level of convenience, though its effectiveness will depend on the quality of voice recognition.

Dor runs on a customized operating system (Dor OS) designed to unify content from various platforms. The OS features an intelligent recommendation engine, which will use AI to suggest content based on user preferences.

The TV includes 1.5 GB of RAM and 8 GB of internal storage, which may be limiting for future app installations or system updates. It is unclear whether additional apps can be downloaded, which could impact long-term usability.

Micromax manufactures the Dor TVs in India, utilizing existing infrastructure with a production capacity of up to 500,000 units per month. It may be recalled that Micromax used to sell TVs in India earlier. This local manufacturing capability supports Micromax’s return to the market and aligns with the Indian government’s “Make in India” initiative.

Cost Comparison and Market Position

The total cost of owning a 43-inch Dor TV for the first year is Rs 19,588, including the activation fee and 11 months of subscription payments. In comparison, a similar 4K TV from brands like Motorola, iFFALCON, or Vu costs approximately ₹20,000, excluding the cost of OTT subscriptions. Access to popular OTT platforms like Prime Video, Disney+ Hotstar, and Zee5 costs an additional ₹8,789 annually, bringing the total cost to nearly ₹28,800 for a comparable experience without Dor. Additionally, you get a 4-year warranty on your TV compared to a 1-year warranty offered by other TV providers in India.

Dor’s subscription model provides a cost advantage, offering savings of around ₹10,000 if you want a new TV. However, the subscription fee is non-refundable, and missing a payment locks the TV. This strict policy could be a concern for consumers who face temporary financial difficulties or want to pause their subscriptions.

Alternative Options and Consumer Choice

In case you don’t want a TV, OTTPlay, another service in India, offers 38 OTT platforms and 500+ live channels for Rs299 per month or Rs2,999 annually. This service does not include Netflix or Prime Video. Adding these separately—Prime Video Lite at Rs999 annually and Netflix’s mobile-only plan at RS149 per month—brings the total cost to Rs5,786 annually. This is significantly lower than Dor’s Rs8,789 annual subscription cost. Do keep in mind that Dor’s doesn’t offer a standalone app aggregator service ( As of now).

Consumers must weigh the trade-offs between cost and convenience. For those in need of a new TV, Dor presents a competitive offering. It combines hardware and content in a single package, spreading the cost over time and reducing the upfront investment. For consumers who already own a smart TV and prefer flexible OTT subscriptions, Dor’s offering may seem restrictive and more expensive as one would putting money for the TV that is not required.

Future Prospects and Challenges

Streambox Media’s subscription model introduces a new way of consuming television content in India. If successful, this could disrupt the traditional smart TV market. The company may expand its offerings to include standalone app-based services, potentially challenging existing OTT aggregators. But we don’t expect it to happen anytime soon.

The success of Dor will depend on factors like content variety, user experience, and the flexibility of subscription plans. As consumer habits evolve, the ability to adapt and offer customized packages could determine Dor’s long-term viability.

Dor’s subscription-based TV service offers a cost-effective option for consumers seeking both hardware and content. It simplifies access to multiple OTT platforms but comes with restrictions that may not appeal to all users. The overall value depends on individual needs, with significant savings for those in the market for a new TV. For others, standalone OTT subscriptions might remain a more attractive option. The next phase of Streambox Media’s strategy will be critical in determining its impact on India’s competitive smart TV market.