Some years back in a move to make cash available to their account holders anytime and anywhere banks launched ATMs and in the last two years most of the banks have launched apps too. But why? The reason being most of the people don’t deal in cash deposited in their accounts every time instead they need access to their account to pay utility and credit card bills, transfer money, do investments and check their account balance before issuing a cheque.

As Nathaniel Branden once said, “The first step toward change is awareness. The second step is acceptance.” This saying fits perfectly for banking apps as currently majority of the smartphone users who have bank accounts are aware that their bank is having a mobile App but they are not using it or have not tried. May be they are not ready to accept it.

But one can expect things to change in near future as all the banks are working hard to make their account holder app experience a pleasurable task and reap the befits of having access to their account 24X7.

Recently, ING Vysya bank too launched a mobile app for Android and iOS smartphone users. Today we are taking a look at how it is different / not different from other.

To start with, believe it not, ING Vysya first of all hired a mobile game designer to design the user interface so that the interactive element comes out boldly in the app and the navigation is simple.

So did they succeed? Yes. The first thing you will see in the app is balance meter on the login screen, which will remind you of speedometer that shows the cash available in your account. It is quite similar home screen of games app like Temple Run 2 where instead of play you have login button and as a replacement for “Take the idol if you dare” message your account balance. If you are not comfortable with auto display of balance you can turn off this feature from setting menu.

In the login screen one can also locate nearest ATM and branch on a map with their address by pressing the locate tab. Though for using this functionality you have to share to location of getting accurate details. One can even find the customer care numbers along with bank phone numbers in this tab.

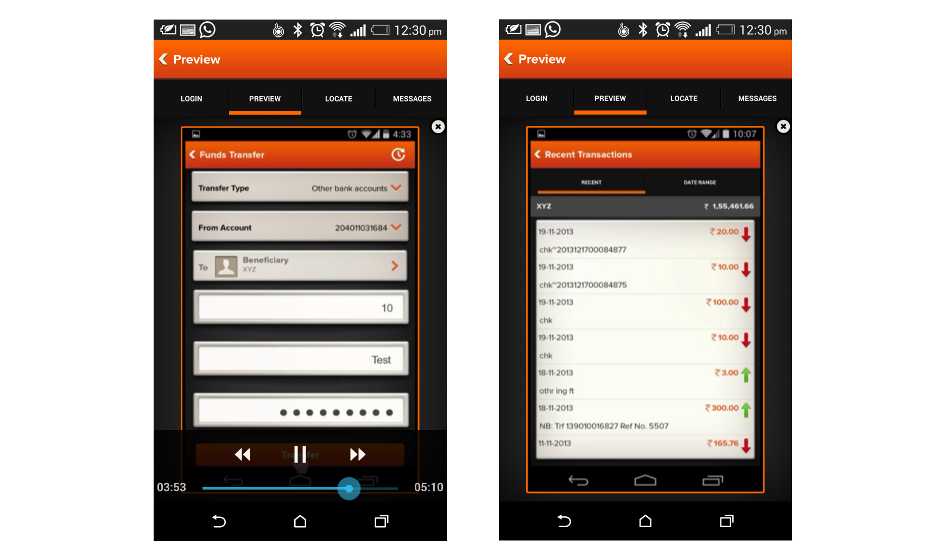

Once you have logged in the main menu, you can check account balance, open a fix deposit or a recurring deposit, pay bills, transfer funds, do shopping and mange you investments by pressing their corresponding tabs. The good point is all the tabs are clearly visible and are placed vertically without any clutter. One doesn’t need pinch in or out to improve readability of text.

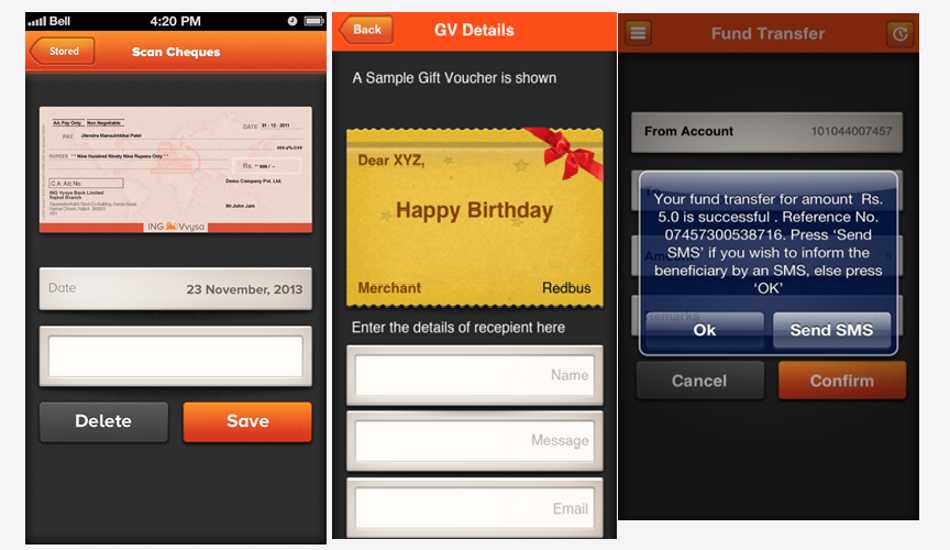

In the fund transfer section there is one interesting feature in ING Vyasa app that allows users an option to send SMS to the person who is receiving fund transfer. Also to help users keep a tab on their issued cheques, the app allows users to click pictures of cheques and store them in this app.

All the other features like bill payment, mobile phone recharge, DTH recharge, service requests, investment and loan management and shopping are there to be utilised and the differentiator will be the user interface or in simple terms we can say look and feel of each page.

Ing Vyasa banking apps look quite interactive and easy to navigate. The only thing that the company needs to improve is to further tighten the security features on the app as currently there is no time limit set in the app for automatically logging out.