India needs fast Broadband access that is cost effective. And while deploying wired broadband is costly, wireless broadband has also become costly thanks to the high price of 3G spectrum.

But now operators are preparing to launch 4G networks, which will bring down the cost and will work at higher speeds. The reason for the low cost of 4G networks is two-fold: one, it will be able to use existing network infrastructure with slight modifications; and second, spectrum for 4G network was licensed to operators at a much lower cost compared to 3G network.

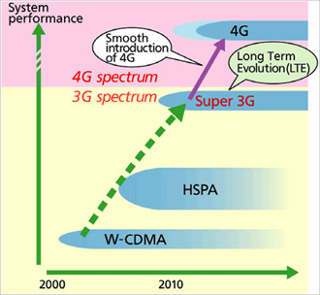

There are two 4G technologies, LTE and WiMax, both offering speeds in excess of 100 Mbps; but LTE is preferred by operators as it is backward compatible, which means that a dongle or phone that works on LTE networks will also work on GSM, CDMA and 3G network.

The problem right now is that devices supporting LTE TDD (the version of LTE that will be deployed in India), are not available right now. But that problem is soon going to become history. Qualcomm has confirmed that LTE devices will be available in bulk by the end of the year. More than 70 percent handsets worldwide use Qualcomm chipsets.

Yesterday, Aircel and Huawei, a telecom equipment solutions provider, jointly conducted the world’s first GSM/UMTS/LTE-TDD trial on Aircel’s existing GSM/3G network in India, using devices based on a Qualcomm multimode chipset. This means that devices are already ready and mass production will start soon.

Yesterday, Aircel and Huawei, a telecom equipment solutions provider, jointly conducted the world’s first GSM/UMTS/LTE-TDD trial on Aircel’s existing GSM/3G network in India, using devices based on a Qualcomm multimode chipset. This means that devices are already ready and mass production will start soon.

Reliance Infotel, which is the only service with pan India spectrum, has also conducted trials for both WiMax and LTE, and is soon expected to announce its choice of technology.

The company is likely to offer bundled devices, which will keep the price of 4G devices (tablets, netbooks and phones) low. Moreover, if it chooses WiMax it will also mean that there will be several options among devices as WiMax devices are already available in the international market and are already cheap, while LTE devices will take time to reach the scale at which prices will decrease.

4G BWA (broadband wireless access) spectrum was auctioned soon after the 3G auctions last year. While Reliance bagged spectrum in all 22 circles, Airtel got licences for four circles, Aircel for eight, Tikona in five circles, and Qualcomm (which is in the market to promote LTE) also bagged spectrum in four circles. BSNL and MTNL had got spectrum even before the auction but have so far launched WiMax in very few locations.