The mobile distribution landscape in India, with its complex structure and diverse players, is a fascinating study of market dynamics. The rising demand for smartphones, coupled with consumers’ diverse preferences and budget constraints, makes India a vibrant and unique market. From manufacturing or importing to the end consumer’s hands, the journey of a mobile phone in India encompasses several stages and key players. Here is an in-depth look at how mobile distribution works in India.

Where do customers purchase their mobile phones?

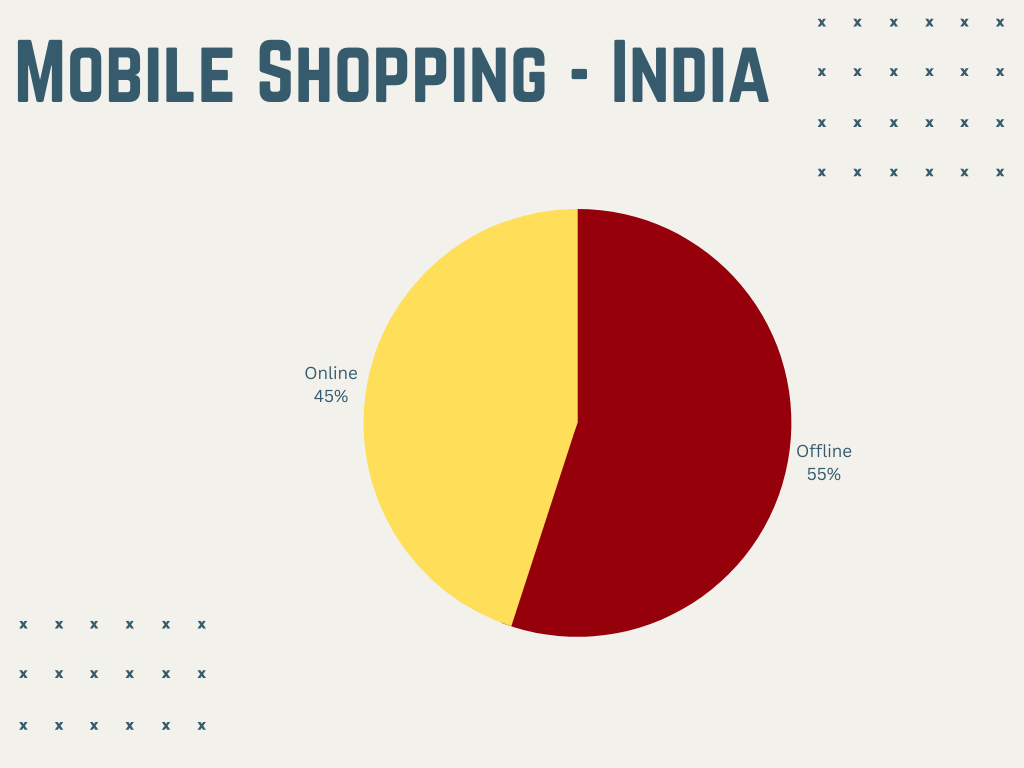

Many brands currently sell smartphones exclusively online across the country. This trend has been gaining momentum for almost a decade. Although some people still prefer to purchase their smartphones in physical stores, they sometimes cannot find the specific product they desire as it is only available online.

When it comes to purchasing phones, Ajay Sharma, who previously served as Business Head at Micromax said, “Approximately 55% of people still prefer to buy them from physical office stores.” This may be the reason why many brands have been focusing on enhancing their offline presence recently.

Manufacturing and Importing

The journey of a mobile phone in India begins at the manufacturing stage. Giants like Samsung, Xiaomi, and Apple either design and manufacture their products in other countries or, increasingly, within India. Over the last few years, many mobile brands have set up manufacturing units in the country under initiatives like’ Make in India’. These units not only cater to the Indian market but, in some cases, serve as export hubs.

In cases where mobile phones are not manufactured domestically, they are imported, but there is a twist. They are not imported as complete units but in CKD or SKD condition to save on duties, which are comparatively higher on the import of a finished final product. Post that brands have to adhere to customs regulations, pay import duties, and ensure compliance with Indian standards and norms. The import process can sometimes affect the distribution timeline, especially in instances of regulatory changes or global supply chain disruptions.

How does a mobile distribution network work?

After the mobile phones are production-ready, they move on to the primary distribution stage. Sharma said, “They are shipped to the smartphone company’s central warehouse, known as the mother warehouse, where the consignment is stored before being shipped to different states.”

He further explains that every brand has a warehouse within the state where they store their smartphones. From there, the phone will either be billed to the state distributor or the city distributor. The state distributor will then send it to the Micro distributor, who will distribute it to dealers in different parts of the city.

The brand handles the transfer cost, including logistics and delivery charges of the consignment from the factory to the mother warehouse to the state warehouse.

The last stage in this journey is the retail stage. In India, mobile phones are sold through a variety of outlets, ranging from large electronics chains to small independent retailers. Some mobile manufacturers also have their own exclusive stores, offering a dedicated space for their products. The above process is followed for independent or pop-and-mom stores.

Regarding offline multi-brand retail stores like Croma, Reliance Digital, and Vijay Sales, their mobile distribution network operates differently. Sharma said, ” Brands handle the billing directly, without involving any distributors. The products are first sent from the brand’s factory to the mother warehouse before being shipped to the retail outlets multi-brand outlets.”

Regarding offline multi-brand retail stores like Croma, Reliance Digital, and Vijay Sales, their mobile distribution network operates differently. Sharma said, ” Brands handle the billing directly, without involving distributors. The products are first sent from the brand’s factory to the mother warehouse before being shipped to the retail outlets of multi-brand outlets or to their mother warehouse.”

Read More: Exclusive: How to use Nothing Glyph Composer on Samsung Galaxy S23 Ultra?

When it comes to the brand’s offline stores, the products are shipped directly from the warehouse to the stores. Sharma stated that although customers may not receive any monetary benefits when visiting multi-brand retail stores like Croma or Vijay Sales, they can still anticipate a superior experience due to the well-trained staff.

Margin Game

In India, the profits earned through mobile phone distribution can fluctuate depending on various factors such as the phone brand, distribution levels, and retail environment. Throwing light on the subject Sharma said, “Currently, the distribution margins range from 2.5% to 3%, while retail margins average at about 4%. Additionally, retail stores can receive additional benefits through brand-related backend schemes based on target achievements. These achievements may involve selling a particular smartphone model more frequently than other models from the brand or clearing out old stock.”

Completing these targets gets the retail stores some extra margin, the percentage of which varies from brand to brand. It is up to the retail store to pass on this extra margin to the consumer in the form of extra discounts on the product.

Can the offline market survive the heat from competition, including online players?

Sharma predicts that while modern trade (such as Reliance store) will see an increase in share, individual stores’ share is expected to decrease with more Modern Trade listed companies like Kore Mobiles going aggressive.

He further said that the primary reason for the growth in the offline market’s share is the experience of purchasing mobile phones as the average selling prices are increasing and look, feel, and experience become more and more important. Also, the offline’s ability, specially in Modern Trade, to offer attractive bundled deals and discounts to customers matching those of online.

Finally, he mentions that the share of the offline market is expected to increase by 4 or 5%. Brands are now considering expanding into the offline market in India to capture a significant portion of the population that prefers to purchase smartphones in person.

What next?

The traditional distribution network, with its deep penetration and wide reach, still holds considerable sway, especially in rural and semi-urban areas. The challenge for mobile manufacturers in the coming years will be to effectively blend these offline and online channels, ensuring comprehensive coverage while leveraging the advantages of digital sales.

The mobile distribution landscape in India is a complex yet vibrant system, constantly evolving to meet consumer demands and market dynamics. It serves as a testament to the robustness and adaptability of India’s commercial ecosystem, and undoubtedly, will continue to innovate and adapt in the years to come.