Google Pay today announced that it has launched support for UPI activation using Aadhaar ID card via National Payments Corporation of India (NPCI). This will enable UPI users to set a PIN for their UPI transactions without the need for a debit card, which is currently the case.

With the Aadhaar-based UPI activation flow, Google Pay users will be able to set their UPI PIN without a debit card. “As UPI scales to the next hundreds of millions of Indian users, this is expected to help many more users set up UPI IDs and enable them to make digital payments”, said the company. This feature is now available to bank account holders of supported banks, while more banks are expected to be added to the list soon.

However, there are certain requirements the users need to meet if they want to use their Aadhaar card for UPI activation. Firstly, they will need to ensure that their phone number registered with UIDAI and bank are the same, and secondly, their bank account is linked with Aadhaar.

Read More: It is time to end Google’s Monopoly in Maps, Apple has already done that: MapmyIndia CEO

How to use Aadhaar card for UPI activation in Google Pay?

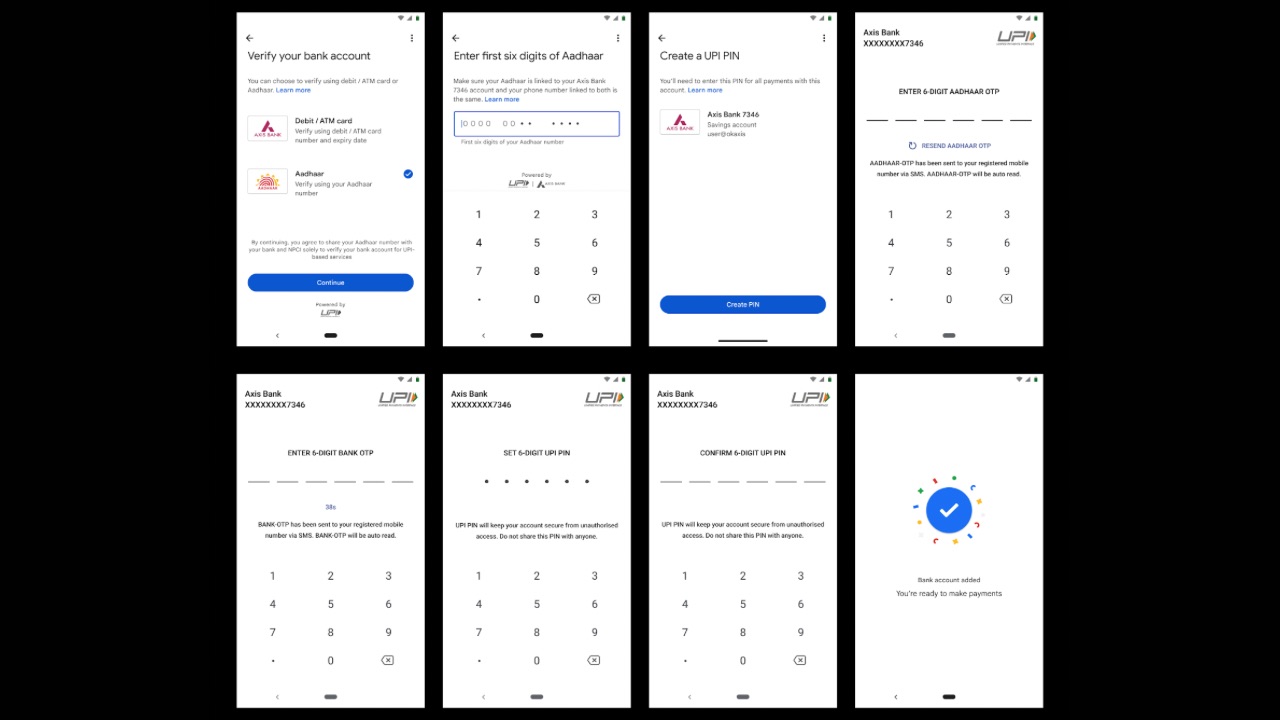

Once users fulfil the requirements mentioned above, they can follow the steps below:

- On Google Pay, users have the option to select between Debit card or Aadhaar based UPI onboarding. If they select Aadhaar, then users will need to enter the first six digits of their Aadhaar number to initiate the process.

- In order to complete the authentication step, users will enter OTPs received from UIDAI and their bank.

- Subsequently, their respective bank will complete the process and they can set their UPI PIN.

Users will then be able to use Google Pay app to make transactions or check balance. Once a user enters the first six digits of an Aadhaar number, it is sent to UIDAI via NPCI for validation. This process ensures the safety of users’ Aadhaar number. Google Pay confirms that it does not store the Aadhaar number and merely acts as a facilitator in sharing the Aadhaar number with the NPCI for validation.