In the ever-evolving landscape of online shopping, customer experience is king. But what happens when design strategies meant to guide shoppers cross the line into manipulation? We suspect that Flipkart, one of India’s largest e-commerce platforms, seems to be using “dark patterns” in its App when a customer wants to pay through EMI.

What are Dark Patterns?

Before we proceed with how a dark pattern on Flipkart app is being used, here’s an overview of what dark patterns essentially are. Dark patterns are deceptive design elements used in websites, apps, or interfaces to manipulate users into taking actions they might not have intended. These tactics exploit human psychology to prioritize business goals, often at the expense of user trust and satisfaction.

A more recent case of dark patterns is when Epic Games, a developer and publisher of Fortnite, was found employing dark patterns within its battle royale title, where it allegedly misled millions of players, including children and teens, into making unintended purchases. It was then fined $275 million for violating COPPA and forced to pay $245 million in refunds to affected consumers, adding up to a record $520 million settlement with the Federal Trade Commission.

How does Flipkart use Dark Patterns in its app?

At the heart of the controversy is Flipkart’s EMI (Equated Monthly Installment) price breakup in its mobile app, which seems to have been designed in such a manner that doesn’t show the buyer the correct final amount they’ll end up paying if they opt for an EMI to make the payment.

EMIs are now being pushed by the banks for consumers to opt for a particular payment method instead of a full one-time payment. That makes it much more beneficial for the consumer as well because not only do they get more time to pay off the amount of their purchase with the flexibility of paying an affordable amount per month, but they also get a higher discount compared to the one-time payment option.

This might explain why Flipkart designed the price breakup section to obscure the actual amount the customer will end up paying. Presenting the EMI option as more affordable upfront could influence buyers to choose this payment method without fully understanding the total cost involved.

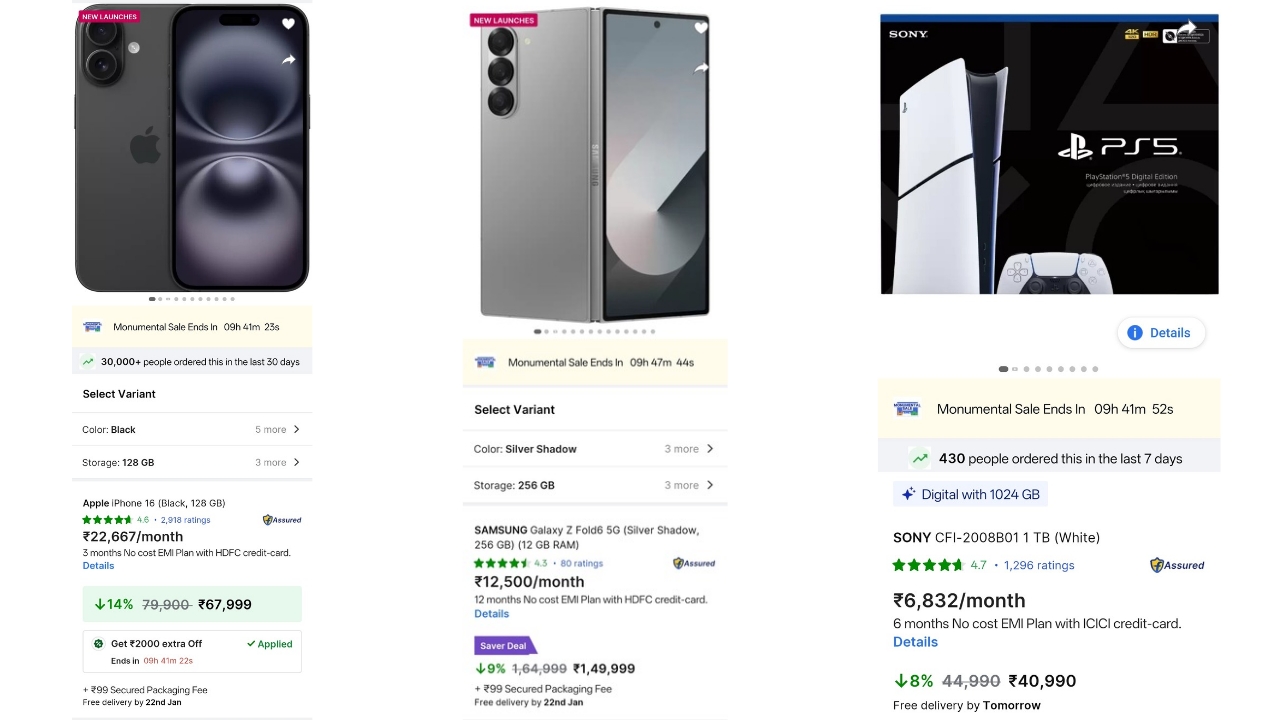

To analyse how Flipkart handles the EMI price breakup section, we selected three products across different price ranges: the PlayStation 5 Slim Digital Edition priced at Rs 40,990, the iPhone 16 listed at Rs 67,999, and the Samsung Galaxy Z Fold 6, available for Rs 1,49,999. These prices were accurate when writing this article, as shown in the screenshots above.

Now, the dark pattern on the Flipkart app can be noticed once you tap the “Pay with EMI” button. Next, you rap on “Continue with EMI” and on the subsequent page, you can choose the card you want to pay with.

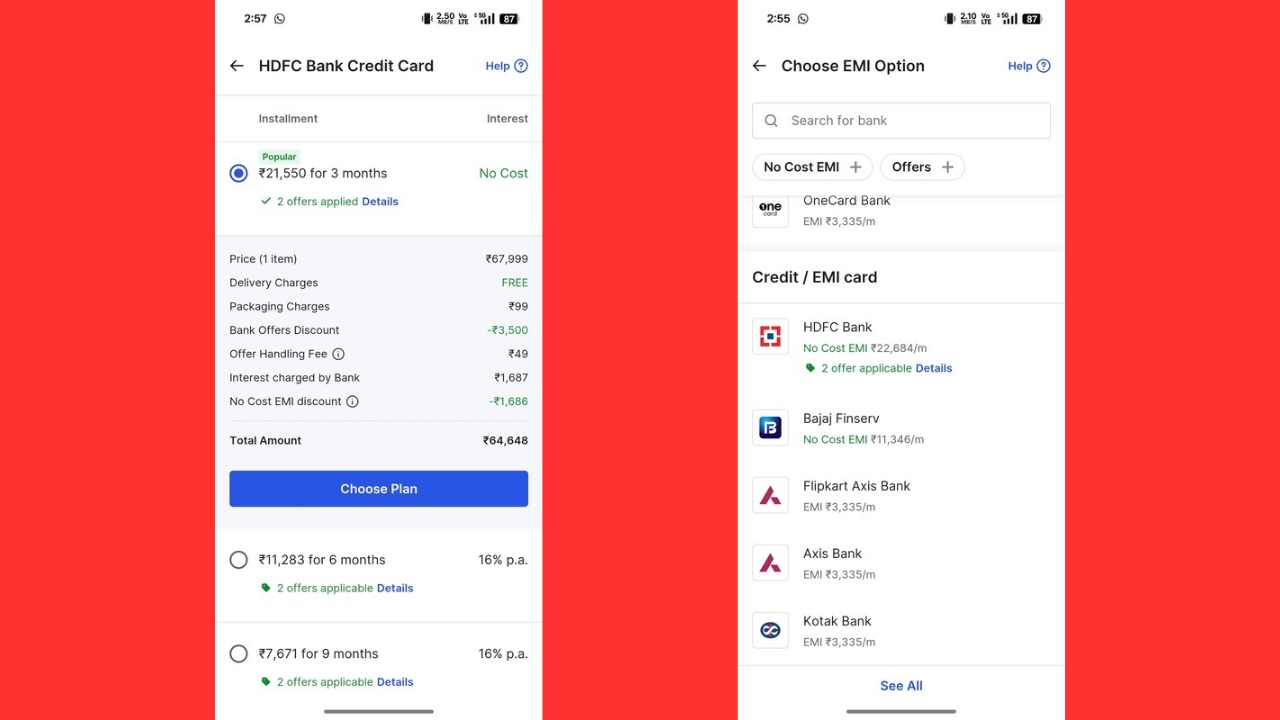

For this instance, we chose the HDFC bank credit card, but the price breakup error is consistent with whatever bank card you choose. Once you tap on the card, you are presented with different options for the duration of the EMI.

As long as it is a No-Cost EMI, the price breakup is shown accurately, including the offer on that product with the particular bank card. As you can see in the screenshot above, for the iPhone 16 128GB version, the price breakup of the 3-month no-cost EMI totals Rs 64,648. If you do the math on a calculator, you’ll get the same result.

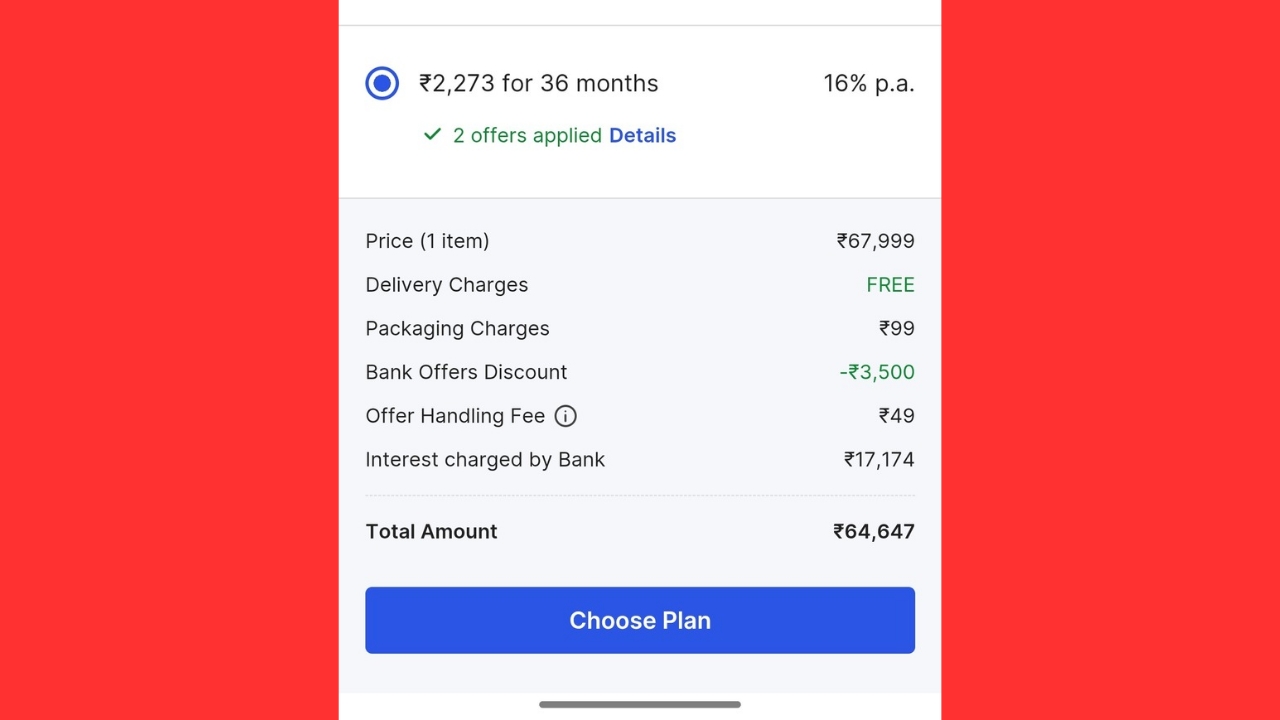

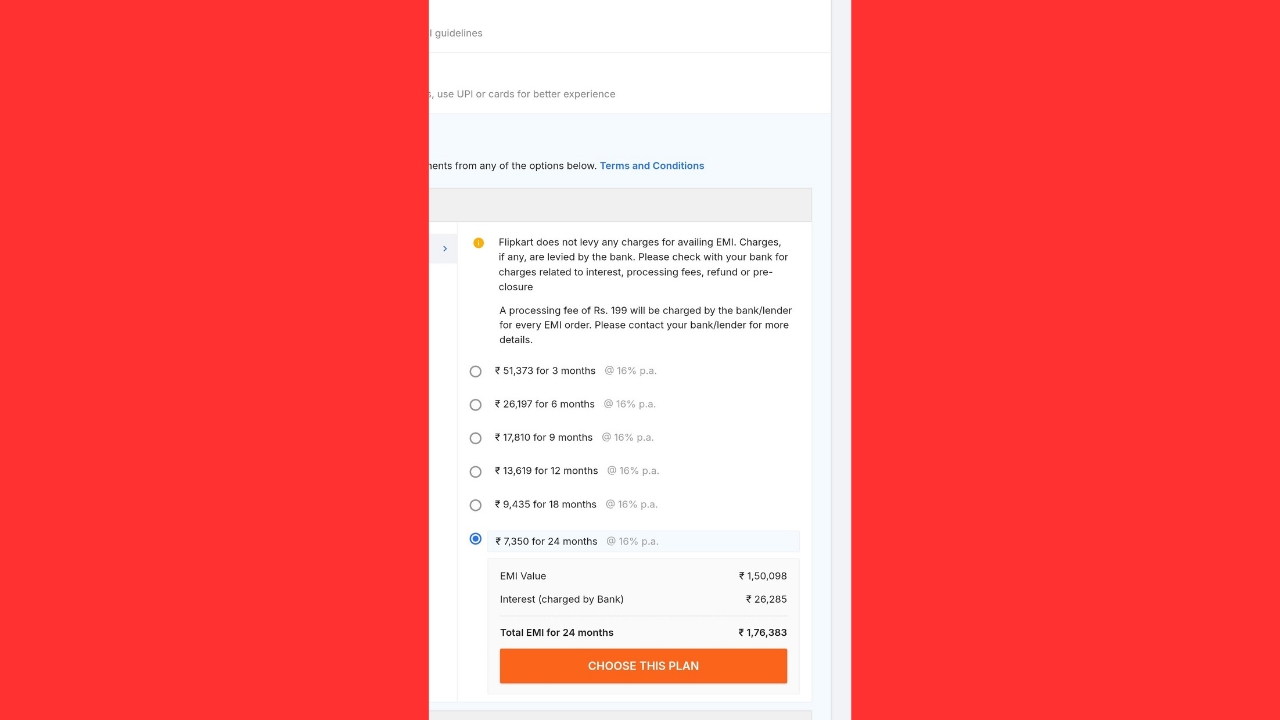

The calculation goes for a toss as soon as you opt for an EMI where you’ll pay interest rate. In the screenshot above, note how the calculation doesn’t include the interest rate you’ll be paying. The calculation shown on the screen provides everything but the interest rate, which is vital when showing the price breakup of a regular EMI.

The total cost you’d be paying for the iPhone 16, in this case, would be Rs 64,647 plus Rs 17,174, which equals Rs 81,821.

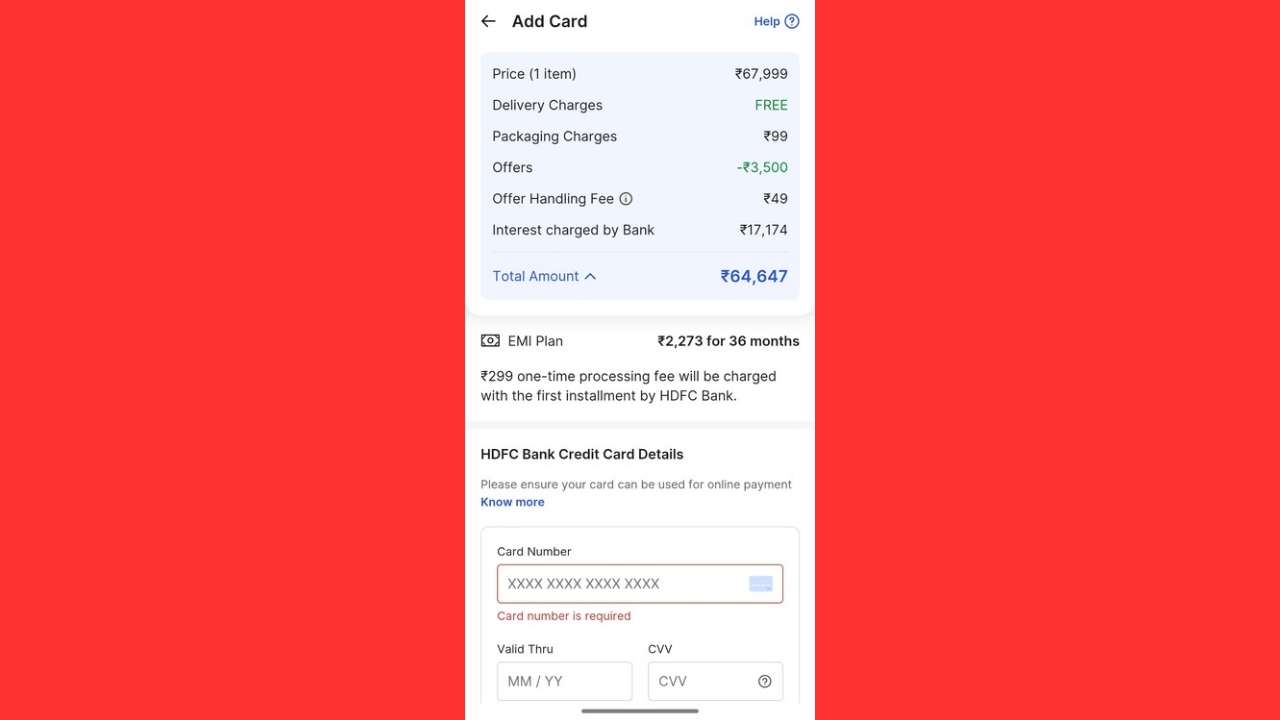

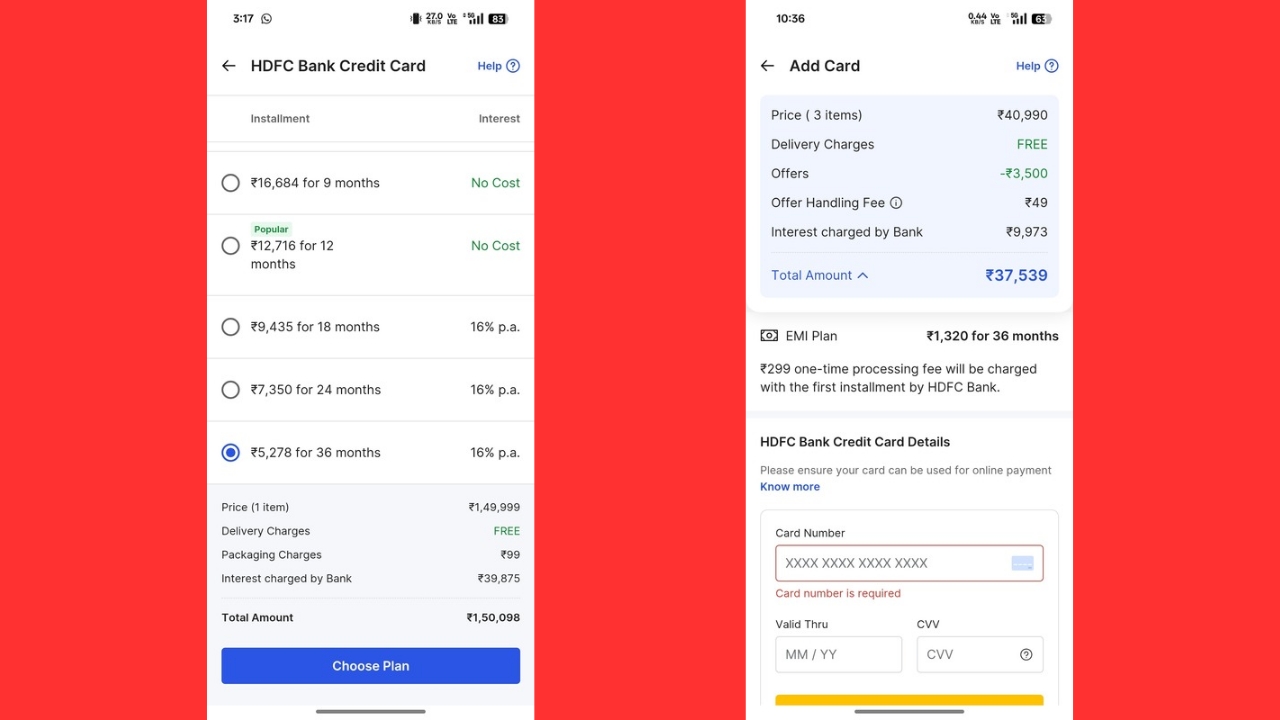

Even after you tap “Choose plan”, the screen where you enter the card details, the price breakup remains identical, i.e., it doesn’t include the interest rate. You can check for yourself as shown above in the screenshot.

As we said, we chose three products for the test and the results are identical to the iPhone 16. The left screenshot shows how Rs 39,875 worth of interest isn’t included in the Galaxy Z Fold 6 breakup, and the right one shows how interest of Rs 9,973 for PS5 Slim isn’t present in the final amount shown.

The interest amount is the most important part of the EMI breakup, which e-commerce platforms should clearly make visible to the buyer in the final amount. An interest amount of Rs 39,875 on a purchase like the Z Fold 6 is a notable amount that should be shown to the buyer.

However, Flipkart seems to be avoiding that, likely to pursue buyers into purchasing by making them think that even without a no-cost EMI, the price hasn’t substantially gone up.

Surprisingly, Flipkart does show the correct total amount you’d pay with EMI when shopping via its website, as shown in the screenshot above.

How are Other Platforms Handling EMI payment Information?

To compare how other platforms manage the EMI breakup, we checked the same on the apps offered by Vijay Sales, Amazon India, and Reliance Digital.

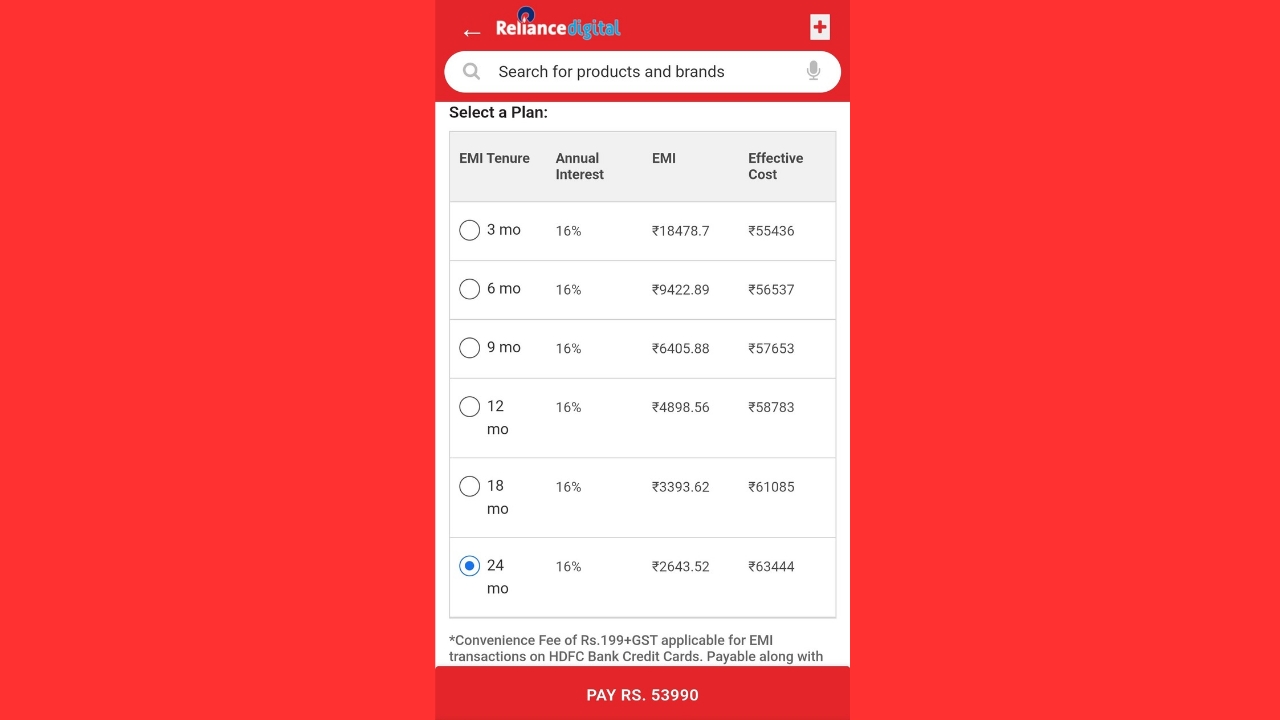

Reliance Digital doesn’t offer EMI payment functionality via its app, so we checked their website, and it does show the correct price breakup. The PS5 Slim was out of stock on the platform so we checked the details for the disc model and the platform clearly shows the final amount you will pay, including the interest amount. While the red button at the bottom shows the pre-interest amount, the effective cost is clearly conveyed to the user in the section above.

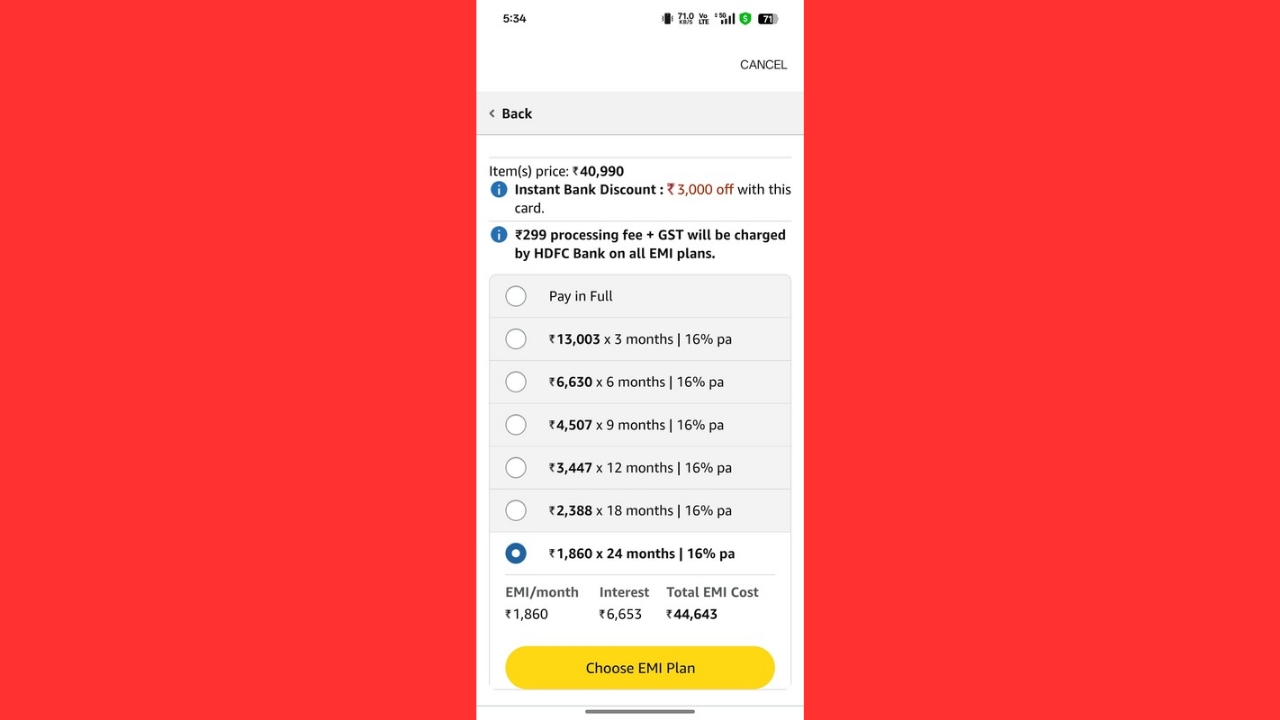

On Amazon, the situation is identical, where the final effective cost, including the interest, is shown under the ‘Total EMI cost’.

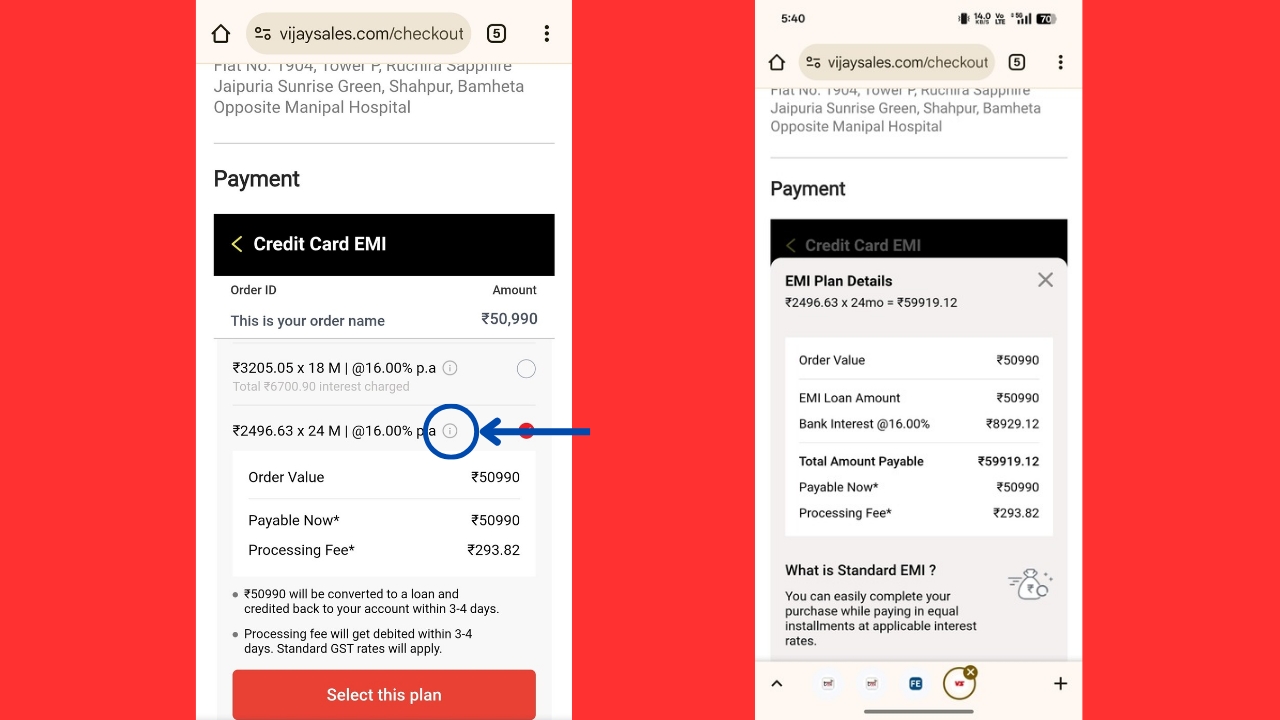

Coming to Vijay Sales, the platform offers a Progressive Web App (PWA) and not a dedicated app such as Flipkart and Amazon. However, even when purchasing through its PWA, an ‘i’ button is shown next to your chosen EMI plan. When you tap on it, a clear calculation is shown, including all the fees, charges, and interest amount you will be charged.

Dark Pattern: Another Reason to Skip Flipkart?

The majority of the users in India now have a smartphone, and with the convenience of apps and how easy the whole process has become, they prefer to make their purchases through these apps by e-commerce platforms instead of going to the platform’s website on a computer.

Even if they don’t have the app, they’d go to Flipkart’s website through a Browser on their smartphone, which will open the mobile view of the page by default unless the user manually requests for the desktop version. Flipkart’s mobile webpage is also affected by the same dark pattern the platform has employed in its app, according to our observation.

While many users are aware and they do the math before making a purchase, many might not do so and think that the final amount is the one shown in the app. Even if a user does the calculation, this poor price breakup may confuse him/her as to what the final amount is in reality.

Flipkart’s questionable design choice for its payments page in its app, specifically concerning the display of EMI details, further tarnishes its reputation in the e-commerce industry. The platform is already plagued by user complaints about issues such as unexplained delivery cancellations, delayed deliveries, unprofessional delivery executive behavior, and refund complications.

Using such deceptive design practices suggests that Flipkart is not prioritizing improving its services or reputation. We strongly advise our readers to meticulously review all pricing details before placing orders on the Flipkart app on mobile to avoid any confusion and unforeseen expenses.