The numbers of 3G subscriber connections in India are forecast to reach 400 million within four years from now, representing almost 30 percent of the country’s total population.

According to a new Wireless Intelligence study, India 3G rollout (forecasts and market shares 2011 — 2015), 3G connections are set to grow three-fold between 2011 and 2015 as operators ramp up rollout of third generation telephony.

Seven Indian operators acquired 3G spectrum last year in addition to the two state-owned operators (BSNL and MTNL) that had already been awarded 3G airwaves ahead of the private auctions.

The study notes that over 80 percent of 3G connections will be based on WCDMA (GSM) in five years, with the remaining 20 percent on CDMA-based 3G networks.

Operators Reliance Communications and Tata Teleservices Ltd (TTSL) have both offered 3G CDMA for a decade; but both are also in the process of migrating to GSM/WCDMA and were the first two private operators to launch services using new 3G spectrum in Q4 2010. Reliance and TTSL are set to command 3G market shares of 39 percent and 30 percent, respectively, this year.

Bharti (in January), Aircel (February) and Vodafone (March) have already launched their services. Idea and Stel will launch services soon. However these launches are in select cities only and the expansion into the tier 2 and 3 cities will take another one year.

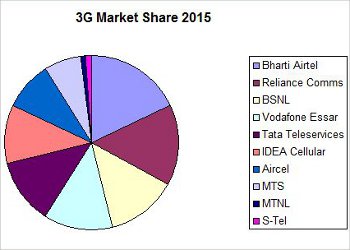

Bharti — India’s largest operator – is forecast to command the largest 3G share (18 percent), followed by Reliance (15 percent) and BSNL (13 percent).

Bharti — India’s largest operator – is forecast to command the largest 3G share (18 percent), followed by Reliance (15 percent) and BSNL (13 percent).

The study notes that India’s Circle A and Circle B service areas will account for 75 percent of the country’s 3G connections by 2015.

Even though initial 3G rollouts are concentrated in the metro areas (Mumbai, Delhi, Chennai, Kolkata) they will soon be outstripped by fast-growing demand for 3G in more populous regions such as Punjab, Bihar, Andhra Pradesh and Haryana.

As non of the operators has spectrum for a nationwide service, most of them are already looking for potential partners. This will complicate the rankings as it is more likely to be joint leadership than single operator winning the race.

Another challenge would be to price the services so that people with limited means can also contribute in the growth.