Unified Payments Interface (UPI) is a fast and convenient way to transfer money between different bank accounts in India through a wide selection of apps. But did you know that you can also use UPI to make payments in some foreign countries? Here is a guide on how to use UPI outside India and which countries accept UPI payments.

How To Activate UPI International?

UPI is a real-time payment system that allows users to send and receive money using a virtual payment address (VPA) or a QR code. Users do not need to share their bank account details or card numbers with the recipient or the merchant. UPI is powered by the National Payments Corporation of India (NPCI) and is supported by over 200 banks and many popular apps such as PhonePe, Google Pay, Paytm, Amazon Pay, and others.

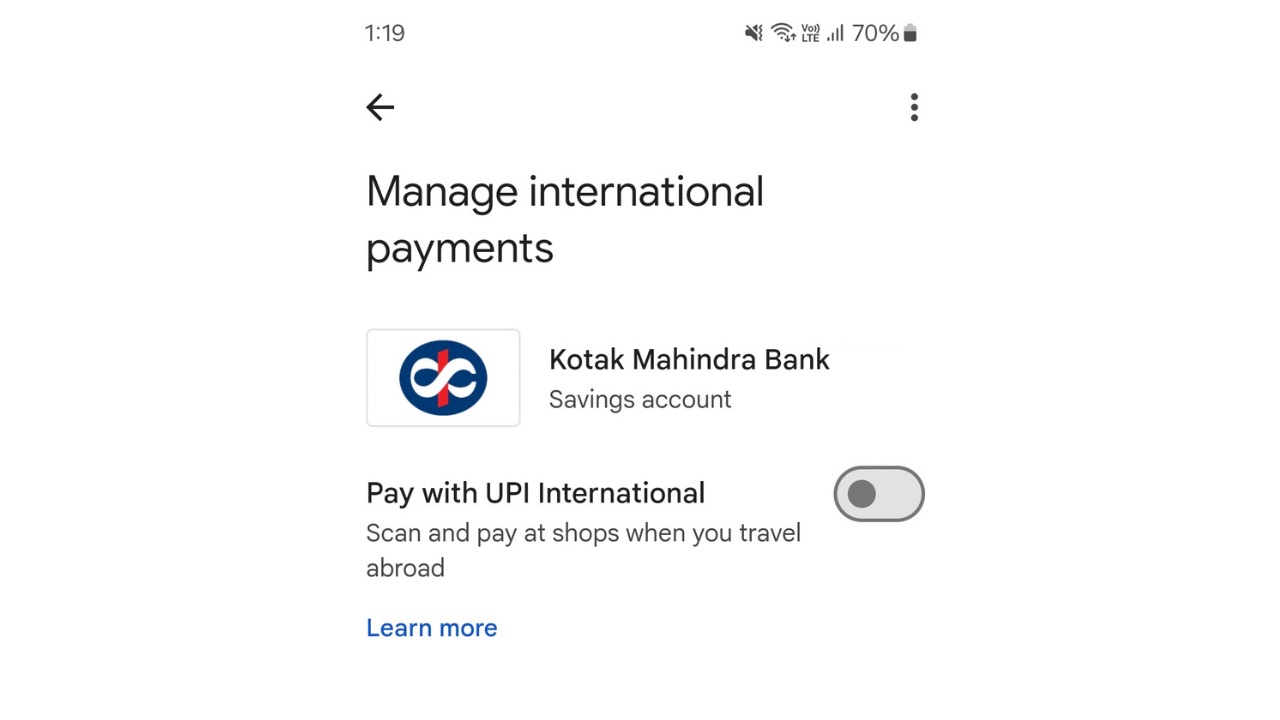

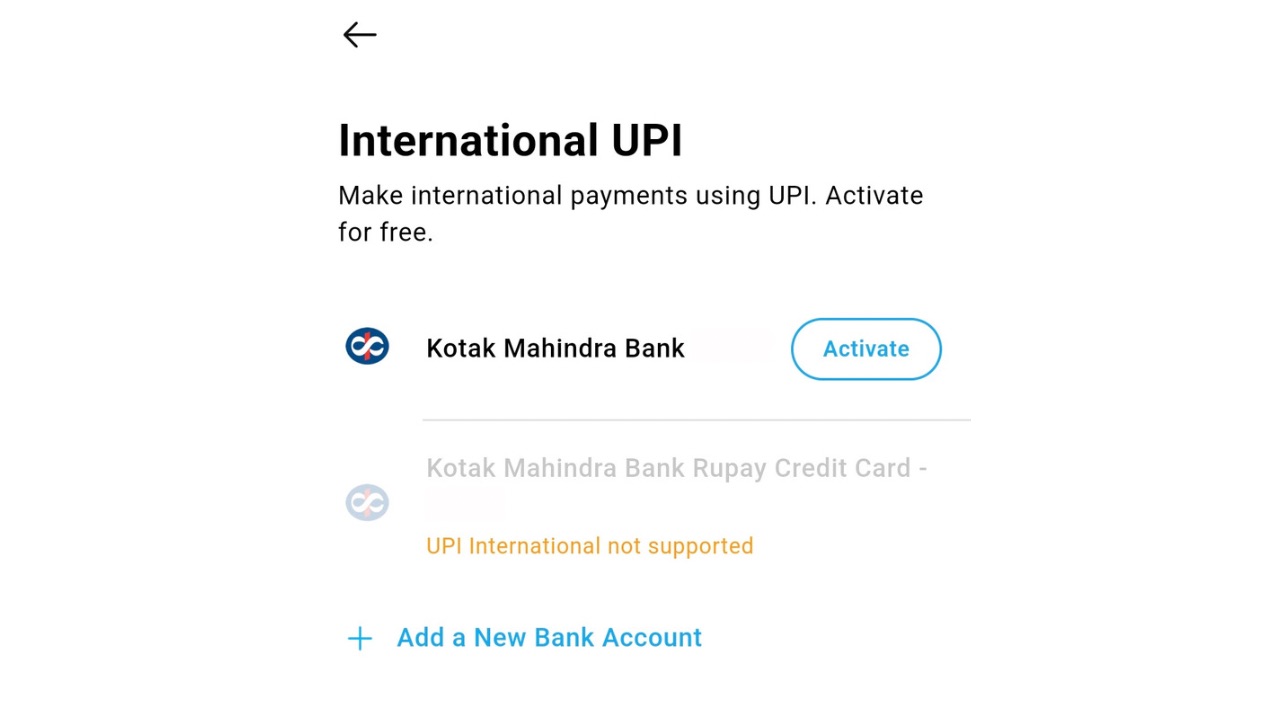

To use UPI outside India, you must activate the UPI International feature on your UPI app, such as Paytm, PhonePe and GPay (Google Pay). The steps may vary slightly depending on the App you use, but the general process is as follows:

Step 1: Open the UPI app and go to the home screen.

Step 2: Click on your profile picture or the menu icon.

Step 3: Under the Payment Settings section, select UPI International.

Step 4: Click the Activate button next to the bank account you wish to use for international UPI payments.

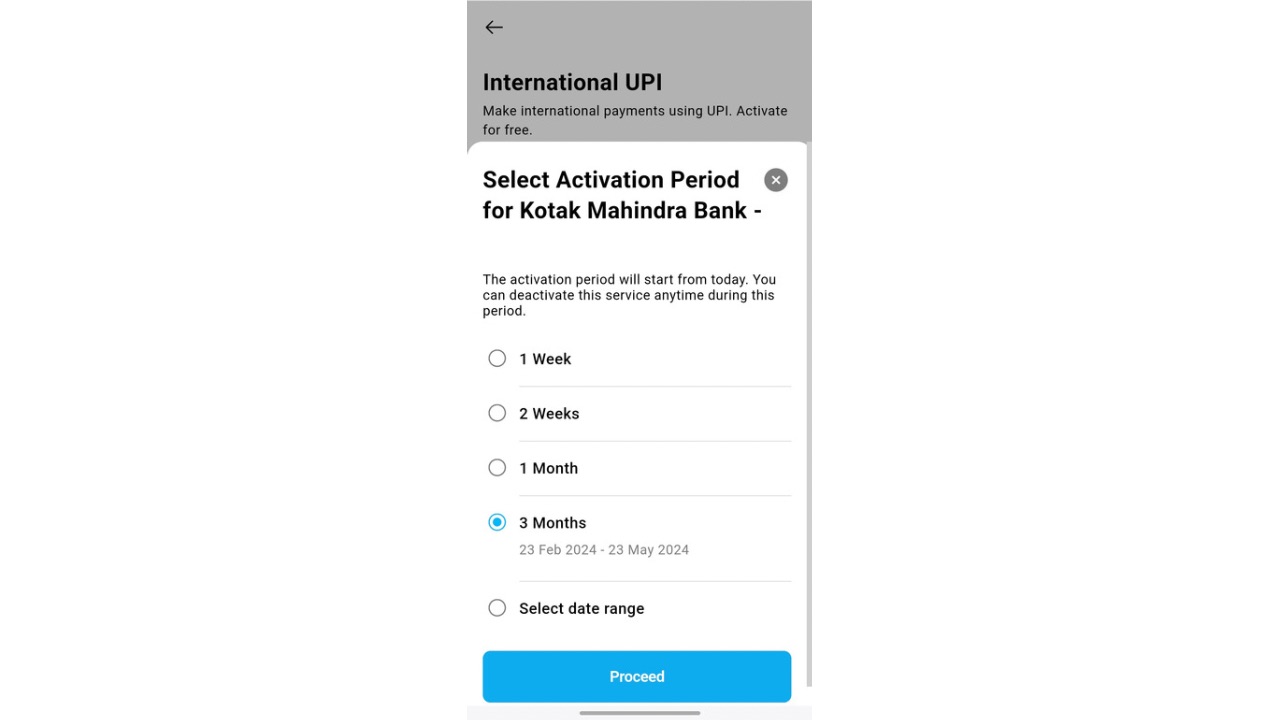

Step 5: Now enter your 6-digit or 4-digit UPI Pin. Some apps like Paytm will ask you how long you want to keep the service enabled. If not, the UPI international service disables automatically after 7 days, but you can enable it again if you wish.

Step 6: You will see a confirmation message on the screen. You can now use UPI outside India.

How to make UPI payments outside India?

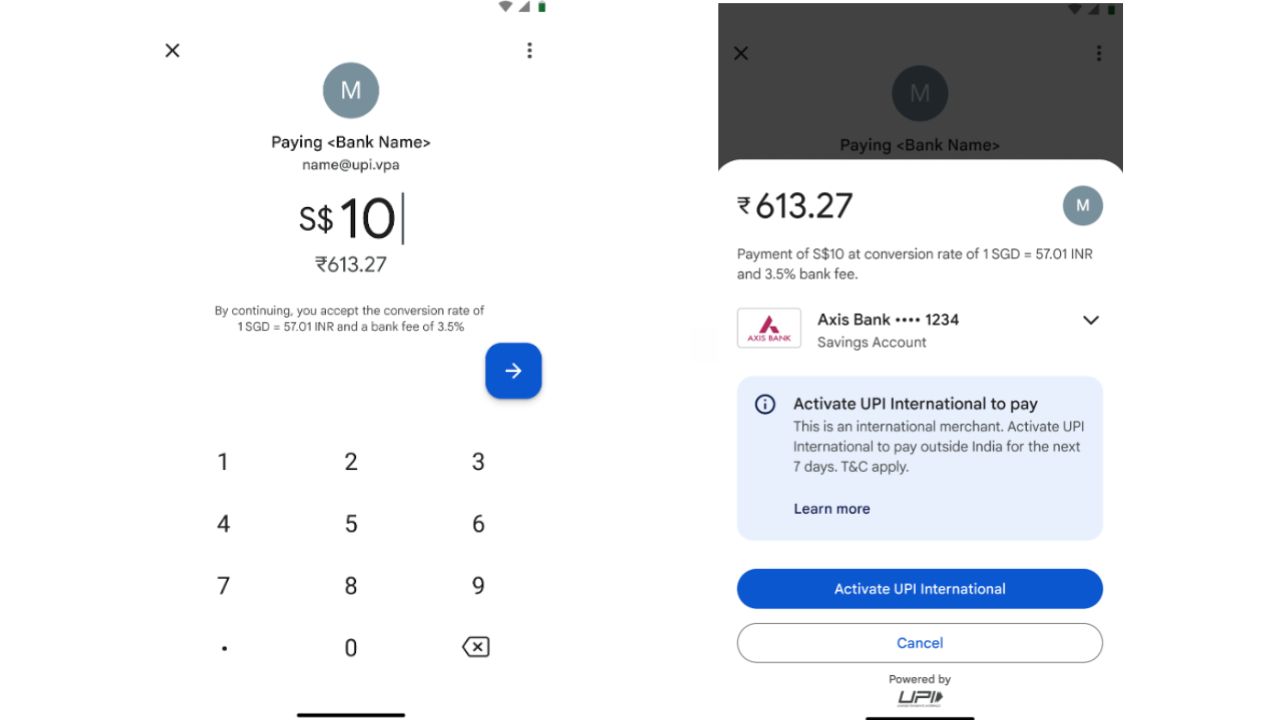

To make UPI payments outside India, you need to scan the QR code of the merchant or the recipient using your UPI app. The QR code should be compatible with UPI, such as Bharat QR or UPI QR. You can also enter the VPA of the recipient if they have one. The steps are as follows:

- Open the UPI app and click on the Scan or Pay option.

- Scan the QR code of the merchant or the recipient, or enter their VPA.

- You will see the details of the transaction on the screen, such as the amount, the currency, and the exchange rate.

- Enter the amount you want to pay, and select the bank account you want to use. The amount will also be shown to you in rupees, as in the amount that will be deducted from your bank account in the form of Indian currency.

- Enter your UPI PIN to authorize the payment.

- You will receive a confirmation message on the screen and a notification on your phone.

Note that using UPI doesn’t mean you are not subject to foreign exchange and bank fees. The exchange rate is calculated based on rates offered by partner banks and is shown below the transaction amount.

Read More: Top 5 Alternatives Of Paytm Wallet

Which Countries Other Than India Support UPI?

Such regions where QR-based UPI payments are supported include:

- France

- Bhutan

- Nepal

- Oman

- UAE

- Malaysia

- Thailand

- Philippines

- Vietnam

- Singapore

- Cambodia

- Hong Kong

- Taiwan

- South Korea

- Japan

- United Kingdom

- Europe

How To Setup UPI on Your International Number?

If you are a non-resident Indian (NRI), you can also access the Unified Payments Interface (UPI) on your international mobile number. The National Payments Corporation of India (NPCI) issued new guidelines last year that allowed NRIs in ten countries to access UPI services using their international mobile numbers for bank accounts that are classified as Non-Resident External (NRE) or Non-Resident Ordinary (NRO) accounts. These countries include:

- Singapore

- Australia

- Canada

- Hong Kong

- Oman

- Qatar

- USA

- Saudi Arabia

- United Arab Emirates

- United Kingdom

As for the steps regarding how to setup UPI on your international number, these are:

- Ensure you have an NRO or NRE account with a bank in India that supports UPI transactions. Then, register your foreign mobile number with your bank account.

- Now, select a UPI app of your choice, such as Paytm, PhonePe or GPay.

- Ensure the app supports linking a bank account via an international phone number as you’ll now have to verify this international mobile number.

- Then, link your NRO/NRE account to the UPI app after you find and tap on your bank’s name.

- Set a UPI PIN, and you are done.